2025 LINEA Price Prediction: Bullish Outlook as Layer 2 Adoption Accelerates

Introduction: LINEA's Market Position and Investment Value

Linea (LINEA), as a next-generation Ethereum Layer 2 network, has been strengthening Ethereum's security, value, and ecosystem since its inception. As of 2025, LINEA's market capitalization has reached $284,561,877, with a circulating supply of approximately 15,482,147,850 tokens, and a price hovering around $0.01838. This asset, known as the "Ethereum Scaler," is playing an increasingly crucial role in expanding Ethereum's capabilities while reinforcing its fundamental strengths.

This article will comprehensively analyze LINEA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. LINEA Price History Review and Current Market Status

LINEA Historical Price Evolution

- 2025 (September): LINEA reached its all-time high of $0.0484, marking a significant milestone for the project.

- 2025 (October): The price experienced a sharp decline, hitting an all-time low of $0.00575, indicating high market volatility.

LINEA Current Market Situation

As of October 18, 2025, LINEA is trading at $0.01838, representing a 1.4% decrease in the last 24 hours. The token has shown mixed performance across different timeframes, with a 1.44% increase in the past hour and a 4.46% gain over the last week. However, it has experienced significant losses of 28.66% and 42.92% over the past 30 days and one year, respectively.

LINEA's market capitalization currently stands at $284,561,877, ranking it 226th in the overall cryptocurrency market. The token's circulating supply is 15,482,147,850 LINEA, which is 21.5% of its total supply of 72,009,990,000 LINEA.

The 24-hour trading volume for LINEA is $1,892,407, indicating moderate market activity. The token's price is currently 62% below its all-time high and 220% above its all-time low, suggesting that it is in a recovery phase from its recent bottom.

Click to view the current LINEA market price

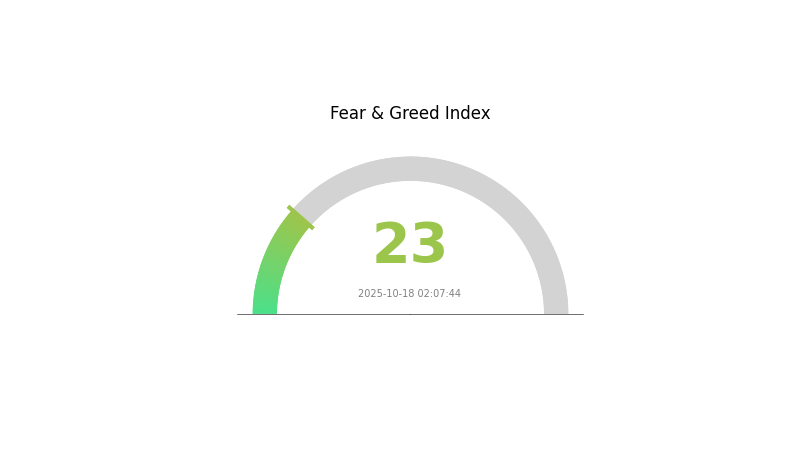

LINEA Market Sentiment Indicator

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to 23. This level of pessimism often presents unique opportunities for savvy investors. While caution is warranted, historical data suggests that periods of extreme fear can precede significant market rebounds. Investors may consider dollar-cost averaging or researching undervalued projects. However, always conduct thorough due diligence and never invest more than you can afford to lose in this volatile market.

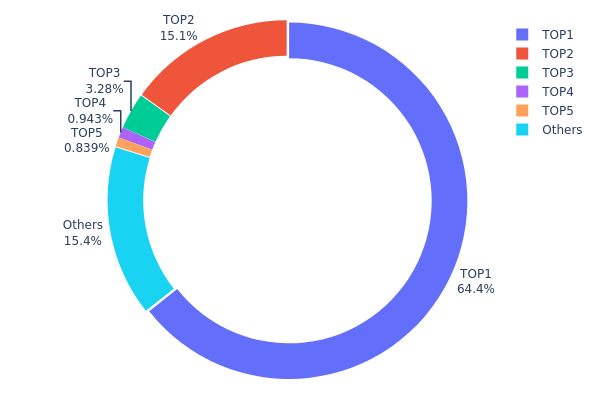

LINEA Holdings Distribution

The address holdings distribution data for LINEA reveals a highly concentrated ownership structure. The top address holds an overwhelming 64.36% of the total supply, with the second-largest holder controlling 15.12%. This extreme concentration raises concerns about centralization and potential market manipulation.

The top five addresses collectively control 84.53% of LINEA tokens, leaving only 15.47% distributed among all other holders. Such a skewed distribution suggests a significant imbalance in token ownership, which could lead to increased volatility and susceptibility to large-scale price movements initiated by a small number of actors. This concentration also poses risks to the network's decentralization ethos and governance structure.

While high concentration is not uncommon in early-stage blockchain projects, the degree observed in LINEA's case is particularly notable. It may indicate that the project is still in its early phases of distribution or that there are significant lock-ups in place. Investors should carefully consider these factors when assessing LINEA's market dynamics and long-term stability.

Click to view the current LINEA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7fbe...7dfc9d | 45974778.11K | 64.36% |

| 2 | 0x8156...cd23ec | 10801498.50K | 15.12% |

| 3 | 0xf977...41acec | 2345760.69K | 3.28% |

| 4 | 0x282e...699491 | 673654.74K | 0.94% |

| 5 | 0xe4b7...e0a008 | 599598.73K | 0.83% |

| - | Others | 11031402.47K | 15.47% |

II. Key Factors Affecting LINEA's Future Price

Technical Development and Ecosystem Building

-

Layer 2 Scaling Solution: LINEA is a Layer 2 scaling solution for Ethereum, designed to improve transaction speed and reduce costs.

-

Ecosystem Applications: LINEA is focusing on building a robust ecosystem with various DApps and projects to increase its utility and adoption.

III. LINEA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01048 - $0.01838

- Neutral prediction: $0.01838 - $0.02187

- Optimistic prediction: $0.02187 - $0.02536 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.01988 - $0.03185

- 2028: $0.02637 - $0.03669

- Key catalysts: Technological advancements, ecosystem expansion, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.03268 - $0.03578 (assuming steady market growth)

- Optimistic scenario: $0.03889 - $0.04437 (with accelerated adoption and positive market sentiment)

- Transformative scenario: $0.04437+ (under extremely favorable conditions and major breakthroughs)

- 2030-12-31: LINEA $0.03578 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02536 | 0.01838 | 0.01048 | 0 |

| 2026 | 0.02909 | 0.02187 | 0.0164 | 19 |

| 2027 | 0.03185 | 0.02548 | 0.01988 | 38 |

| 2028 | 0.03669 | 0.02867 | 0.02637 | 55 |

| 2029 | 0.03889 | 0.03268 | 0.02255 | 77 |

| 2030 | 0.04437 | 0.03578 | 0.03399 | 94 |

IV. LINEA Professional Investment Strategy and Risk Management

LINEA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Ethereum's scaling solutions

- Operation suggestions:

- Accumulate LINEA tokens during market dips

- Stay informed about Linea's ecosystem development and adoption

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor Ethereum's performance as it may affect LINEA

- Pay attention to major ecosystem announcements and partnerships

LINEA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various Layer 2 solutions

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be cautious of phishing attempts

V. LINEA Potential Risks and Challenges

LINEA Market Risks

- Volatility: High price fluctuations common in the crypto market

- Competition: Other Layer 2 solutions may gain more traction

- Ethereum upgrades: Potential impact on Layer 2 demand

LINEA Regulatory Risks

- Uncertain regulations: Potential for increased scrutiny of Layer 2 solutions

- Compliance requirements: Possible need for adaptations to meet regulatory standards

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

LINEA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Unforeseen issues in handling increased network load

- Interoperability concerns: Potential difficulties in cross-chain interactions

VI. Conclusion and Action Recommendations

LINEA Investment Value Assessment

LINEA presents a promising investment opportunity as an Ethereum Layer 2 scaling solution. Its long-term value proposition lies in its potential to enhance Ethereum's scalability and efficiency. However, short-term risks include market volatility and competition from other scaling solutions.

LINEA Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics

✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance

✅ Institutional investors: Explore strategic partnerships and ecosystem involvement

LINEA Trading Participation Methods

- Spot trading: Buy and hold LINEA tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities within the Linea ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of linea coin?

Linea coin shows promise for growth, potentially reaching new highs by 2026. Its focus on scalability and Ethereum compatibility may drive adoption and value increase in the evolving Web3 ecosystem.

How high can Linea go?

Linea could potentially reach $5-$10 by 2026, driven by its Layer 2 scaling solutions and Ethereum ecosystem growth.

What is the price prediction for linea in 2026?

Based on current market trends and potential growth, Linea's price could reach $5 to $7 by 2026, driven by increased adoption and ecosystem expansion.

Can XRP hit $20 in 2025?

While ambitious, XRP reaching $20 in 2025 is possible given potential market growth and increased adoption. However, it would require significant developments in the crypto space and Ripple's ecosystem.

XION vs OP: Comparing Layer 2 Solutions for Ethereum Scalability and Performance

QUAI vs OP: Comparing Two Innovative Layer-2 Scaling Solutions for Blockchain Ecosystems

Understanding Mantle Network: A Comprehensive Guide to Crypto Solutions

Aptos vs Giants: Performance Analysis & Market Share of This Rising Layer 1 Blockchain

Crypto Assets bankruptcy news

2025 SUI价格预测:区块链新贵的未来发展与投资价值分析

Unlocking Bitcoin's Full Potential: How the Lightning Network Enhances Scalability

Comprehensive Guide to Using Digital Payments with Cryptocurrencies

Evaluating Major Ethereum Scalability Solutions

Understanding the Security Challenges of Wrapped Tokens

Guide to Purchasing Wiener AI Tokens Securely