2025 IN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of IN

INFINIT (IN) is an AI-powered DeFi intelligence protocol that enables users to discover, evaluate, and execute DeFi opportunities through intelligent agents and natural language interfaces. Since its launch in late 2024, INFINIT has established itself as a pioneering platform in the Agentic DeFi Economy. As of December 2025, IN boasts a market capitalization of approximately $80.06 million with a circulating supply of around 228.33 million tokens, currently trading at $0.08006. This innovative asset, recognized as a "gateway to democratized DeFi access," is playing an increasingly vital role in simplifying complex decentralized finance strategies for mainstream users.

INFINIT is backed by prominent investors including Electric Capital, Mirana Ventures, Hashed, and Lightspeed Faction, underscoring its credibility and growth potential within the Web3 ecosystem.

This comprehensive analysis will examine IN's price trajectory from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for stakeholders.

INFINIT (IN) Market Analysis Report

I. IN Price History Review and Market Status

IN Historical Price Evolution

- October 10, 2025: All-time high (ATH) achieved at $0.32118, representing peak market sentiment and investor interest in the protocol.

- September 5, 2025: All-time low (ATL) recorded at $0.05379, marking the lowest valuation point since launch.

- December 20, 2025: Current trading price at $0.08006, positioned between historical extremes with a recovery trend from recent lows.

IN Current Market Situation

As of December 20, 2025, IN is trading at $0.08006 with a 24-hour trading volume of $56,547.93. The token demonstrates significant intraday volatility, with a 24-hour price range between $0.0718 and $0.08534. Short-term momentum shows strength with a 10.76% gain over the past 24 hours, though the 7-day performance reflects a -6.26% decline, indicating potential consolidation after recent volatility. Over a 30-day period, the token has appreciated 11.4%, suggesting underlying bullish sentiment despite near-term fluctuations.

The fully diluted valuation (FDV) stands at $80,060,000, with a current market capitalization of $18,280,366.67. The circulating supply represents 22.83% of the maximum 1 billion token supply (228,333,333.33 IN in circulation), indicating substantial future dilution potential as tokens are released. INFINIT maintains a market dominance of 0.0024%, reflecting its position as an emerging protocol in the decentralized finance sector.

With 623 token holders and an exchange presence, IN operates on the Ethereum blockchain as an ERC-20 token. Current market conditions reflect extreme fear sentiment (VIX: 20), which often precedes significant market movements.

Click to view current IN market price

IN 市场情绪指标

2025-12-20 恐惧与贪婪指数:20(Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and investor anxiety. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors who view downturns as potential entry points. However, caution is warranted as markets may continue declining before stabilizing. Monitor key support levels and consider dollar-cost averaging strategies on Gate.com if you're planning to build positions during this fearful sentiment phase.

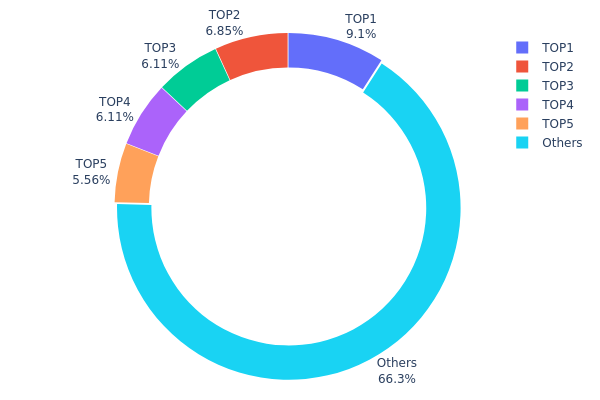

IN Holdings Distribution

The address holdings distribution map illustrates the concentration of IN tokens across blockchain addresses, revealing the degree of wealth centralization within the network. By analyzing the top holders and their respective percentages of total supply, this metric provides critical insights into potential market risks, including price manipulation vulnerability and network decentralization levels.

Current data demonstrates a moderately concentrated distribution pattern. The top five addresses collectively control approximately 33.71% of the circulating supply, with the largest holder accounting for 9.09%. While this concentration level is notable, it does not represent extreme centralization compared to many emerging tokens. The remaining 66.29% distributed among other addresses suggests a relatively healthy level of decentralization at the lower tier, though the presence of significant individual holders warrants continued monitoring.

The distribution structure presents both opportunities and considerations for market dynamics. The substantial holdings concentrated in the top addresses could potentially influence price movements during periods of high volatility, as coordinated actions by major holders could accelerate market swings. However, the majority of supply remaining dispersed among numerous other addresses provides a stabilizing mechanism against unilateral market manipulation. The current configuration indicates a market structure transitioning toward broader distribution, suggesting growing retail participation and institutional adoption spreading the token's ownership base.

Click to view the current IN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xab0a...486fce | 81837.56K | 9.09% |

| 2 | 0xbe83...daea8a | 61678.46K | 6.85% |

| 3 | 0x6e64...f15f40 | 55000.00K | 6.11% |

| 4 | 0xaa2d...f0899a | 55000.00K | 6.11% |

| 5 | 0x69ad...0d8897 | 50000.00K | 5.55% |

| - | Others | 596256.19K | 66.29% |

II. Core Factors Influencing Future Price of IN

Supply Mechanism

- Halving Events: The halving mechanism directly limits new supply, creating scarcity effects. Historical data demonstrates that halving events have historically preceded significant price appreciation periods.

- Historical Patterns: Past supply reduction events have supported price increases due to the fundamental principle of limited new token issuance.

- Current Impact: Supply constraints continue to create upward pressure on valuations through the restricted growth of circulating supply.

Macroeconomic Environment

- Monetary Policy Impact: Major central banks are expected to maintain cautious monetary policies, which will likely influence the overall cryptocurrency market dynamics. Market sentiment remains sensitive to global monetary policy shifts.

- Inflation Hedge Attributes: Cryptocurrencies, including IN, serve as potential inflation hedging instruments. During periods of elevated inflation, investors may increase allocation to digital assets as portfolio diversification and value preservation tools.

- Geopolitical Factors: International developments and global uncertainty can drive investors toward alternative assets, potentially benefiting the broader cryptocurrency market and specific digital assets.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Cryptocurrency investment carries substantial risks. Please conduct thorough due diligence before making investment decisions. You can trade IN spot on Gate.com.

III. 2025-2030 IN Price Forecast

2025 Outlook

- Conservative Forecast: $0.0768 - $0.0792

- Base Case Forecast: $0.0792

- Bullish Forecast: $0.1141 (requires sustained market recovery and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with progressive upward momentum

- Price Range Predictions:

- 2026: $0.0648 - $0.1208 (20% upside potential)

- 2027: $0.0674 - $0.1446 (35% upside potential)

- 2028: $0.0823 - $0.1647 (58% upside potential)

- Key Catalysts: Ecosystem expansion, increased institutional interest, improved market sentiment, and technological upgrades

2029-2030 Long-term Outlook

- Base Scenario: $0.1457 - $0.2195 (assumes steady ecosystem growth and market stabilization)

- Bullish Scenario: $0.1894 - $0.2195 (2029-2030, requires accelerated adoption and positive regulatory developments)

- Transformational Scenario: $0.2195+ (contingent on breakthrough partnerships, major protocol enhancements, and broader market bull run)

- 2030-12-31: IN price target $0.2195 (109% cumulative gain from current levels, representing significant long-term appreciation)

Note: Investors should monitor IN token on Gate.com for real-time price movements and execute positions according to their individual risk tolerance and investment timeline.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.11408 | 0.07922 | 0.07684 | -1 |

| 2026 | 0.12081 | 0.09665 | 0.06475 | 20 |

| 2027 | 0.14461 | 0.10873 | 0.06741 | 35 |

| 2028 | 0.16467 | 0.12667 | 0.08234 | 58 |

| 2029 | 0.18937 | 0.14567 | 0.09906 | 81 |

| 2030 | 0.21945 | 0.16752 | 0.14574 | 109 |

INFINIT (IN) Professional Investment Strategy and Risk Management Report

IV. IN Professional Investment Strategy and Risk Management

IN Investment Methodology

(1) Long-term Hold Strategy

- Suitable investors: DeFi enthusiasts, AI-powered protocol believers, and investors with 1-3 year investment horizons

- Operation recommendations:

- Accumulate during market corrections when prices fall below the 30-day average, taking advantage of volatility

- Maintain consistent positions through market cycles to benefit from INFINIT's protocol adoption growth

- Reinvest any rewards or gains to compound your holdings over time

(2) Active Trading Strategy

- Technical analysis considerations:

- Price volatility patterns: Monitor the recent trading range between $0.0718 and $0.08534 (24-hour highs and lows) to identify entry and exit points

- Historical resistance and support: Key resistance at $0.32118 (all-time high on October 10, 2025) and support at $0.05379 (all-time low on September 5, 2025)

- Wave operation key points:

- Capitalize on the 10.76% 24-hour price increase by identifying momentum reversals around established support levels

- Execute trades during high volume periods to ensure optimal liquidity and minimal slippage

IN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 2-3% allocation to IN within total crypto portfolio

- Active investors: 5-8% allocation, with regular rebalancing quarterly

- Professional investors: 8-15% allocation with systematic hedging strategies

(2) Risk Hedging Solutions

- Diversification approach: Combine IN holdings with stablecoins or other established DeFi protocols to reduce concentration risk

- Position sizing discipline: Limit individual trades to 2-5% of total portfolio value to manage drawdown exposure

(3) Secure Storage Solution

- Non-custodial solution: Gate Web3 Wallet provides secure, self-custodial storage for ERC-20 tokens including IN, with direct integration to Gate.com for seamless trading

- Hardware security option: For large holdings exceeding $10,000, consider using hardware security modules with backup recovery phrases stored in secure locations

- Safety considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify smart contract addresses before any token interactions

V. IN Potential Risks and Challenges

IN Market Risks

- Liquidity concentration: Trading volume of $56,547.93 in 24 hours indicates relatively limited liquidity compared to established DeFi protocols, potentially resulting in higher slippage for large transactions

- Price volatility exposure: The token has declined 6.26% over 7 days and experienced a 73.2% drawdown from its all-time high, reflecting significant market sentiment fluctuations

- Adoption uncertainty: As an emerging AI-powered DeFi protocol, widespread user adoption remains unproven, creating uncertainty around long-term demand for the IN token

IN Regulatory Risks

- DeFi regulatory ambiguity: Evolving global regulations around decentralized finance and AI-driven financial services may impact protocol operations and token utility

- Jurisdiction-specific restrictions: Certain jurisdictions may restrict access to AI-powered financial protocols, limiting INFINIT's addressable market

- Compliance requirements: Future regulatory frameworks could require protocol modifications that affect token economics or governance

IN Technology Risks

- Smart contract vulnerability: Like all DeFi protocols, INFINIT's smart contracts face potential security risks; thorough audits and ongoing security monitoring are essential

- AI model reliability: Dependence on artificial intelligence for strategy generation introduces risks related to model accuracy, bias, and unexpected behavioral outcomes

- Protocol scalability: As transaction volume grows, the protocol must effectively scale to maintain performance and cost efficiency across supported blockchain networks

VI. Conclusion and Action Recommendations

IN Investment Value Assessment

INFINIT represents an innovative intersection of artificial intelligence and decentralized finance, positioning itself within the growing "Agentic DeFi" economy. With backing from prominent investors including Electric Capital, Mirana Ventures, Hashed, and Lightspeed Faction, the project demonstrates institutional confidence. However, the token's relatively young market history (approximately 3.5 months), limited trading volume, and unproven protocol adoption create material risks. The 22.83% circulating supply ratio suggests significant future dilution potential. Investors should view IN as a speculative, high-risk opportunity suitable only for those with substantial risk tolerance and the ability to withstand potential total loss.

IN Investment Recommendations

✅ New investors: Start with small exploratory positions (0.5-2% of crypto allocation) after understanding the protocol's AI-agent mechanics through the whitepaper; avoid FOMO-driven purchases during price rallies

✅ Experienced investors: Consider 3-8% allocations as part of a diversified DeFi portfolio; use technical analysis around the $0.0718-$0.08534 range to optimize entry points; maintain strict stop-loss discipline

✅ Institutional investors: Conduct comprehensive due diligence on smart contract audits, team credibility, and tokenomics sustainability; consider DCA (Dollar-Cost Averaging) strategies to mitigate entry timing risk

IN Trading Participation Methods

- Gate.com spot trading: Buy and sell IN directly using multiple currency pairs and fiat on-ramps; access real-time market data and charting tools

- Limit order strategies: Set predetermined buy/sell orders at key technical levels ($0.0718 support and $0.08534 resistance) to automate trading without constant monitoring

- Portfolio tracking integration: Use Gate Web3 Wallet alongside Gate.com to monitor IN holdings, track performance against market benchmarks, and maintain comprehensive portfolio records

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and circumstances. Consulting with a qualified financial advisor is strongly recommended. Never invest more capital than you can afford to lose completely.

FAQ

Is pi going to be worth anything?

Pi's value depends on market adoption and utility development. With growing community engagement and potential real-world applications, Pi has significant potential to gain substantial value in the future cryptocurrency market.

What is the PI price prediction for 2025?

PI is currently trading at $0.2018. Cryptopolitan forecasts an average price of $0.40 by end of 2025, with estimates ranging from $0.27 to $0.42. However, some analysts predict more conservative long-term trends.

How do I mine PI coins and what is the current value?

Download the Pi Network app to start mining. PI coins are currently not tradable on secondary markets, so they have no market value yet. Mining rewards accumulate in your account for future use.

What factors could affect PI Network's price in the future?

PI Network's price could be influenced by adoption rate growth, regulatory developments, market sentiment in cryptocurrency, transaction volume, and overall blockchain ecosystem expansion. These factors determine long-term price trajectory and market dynamics.

Is PI Network a legitimate cryptocurrency project?

Pi Network is a decentralized cryptocurrency project with an active community. It operates on a consensus mechanism and has developed its own blockchain. However, it remains relatively new and faces ongoing scrutiny regarding mainstream adoption and long-term viability in the crypto market.

Is Hey Anon (ANON) a Good Investment?: Analyzing the Potential Returns and Risks of This Emerging Cryptocurrency

Is Hive AI (BUZZ) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 GIZA Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

2025 ALCH Price Prediction: Bullish Outlook as DeFi Adoption Surges

Is Velvet (VELVET) a good investment? : Analyzing the potential and risks of this new cryptocurrency

2025 UNO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is LimeWire (LMWR) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Worldcoin Future: Can AI and Investment Drive WLD to $4 by 2030?

How Do Crypto Derivatives Market Signals Reveal Future Price Trends With Funding Rates and Liquidation Data?

How to Measure Crypto Community and Ecosystem Engagement: Twitter Followers, Developer Contributions, and DApp Activity

WCOIN Launch Details, Price Outlook, and Acquisition Guide on Telegram