2025 年 GRASS 价格预测:深入分析市场趋势及潜在增长驱动因素

引言:GRASS 的市场定位与投资价值

Grass(GRASS)作为互联网带宽共享网络,自诞生以来实现了快速成长。截至 2025 年,GRASS 市值达到 $136,562,356,流通量约 313,360,158 枚,币价维持在 $0.4358 左右。该资产被誉为“互联网带宽共享通证”,在去中心化互联网资源利用领域占据愈发重要的位置。

本文将以历史走势、市场供需、生态建设和宏观经济为基础,深入分析 GRASS 2025-2030 年的价格趋势,为投资者提供权威价格预测及实用投资策略。

一、GRASS 价格历史回顾及当前市场现状

GRASS 历史价格演变

- 2024 年:项目启动,11 月 8 日价格最高至 $3.9691

- 2025 年:市场调整,10 月 10 日跌至历史最低 $0.1698

GRASS 当前市场现状

截至 2025 年 10 月 20 日,GRASS 交易价格为 $0.4358,24 小时成交量 $732,922,近 24 小时下跌 1.22%。当前 GRASS 以 $136,562,356 市值在加密市场排名第 349 位。

近期 GRASS 价格波动剧烈。过去一周累计下跌 18.47%,近一个月下跌 50.71%,短中期呈现下行趋势。

当前价格远低于 2024 年 11 月 8 日创下的历史高点 $3.9691,但已从 2025 年 10 月 10 日的历史低点 $0.1698 有所回升。

流通量为 313,360,158 枚,占总量 1,000,000,000 枚的 31.34%,完全稀释市值为 $435,800,000。

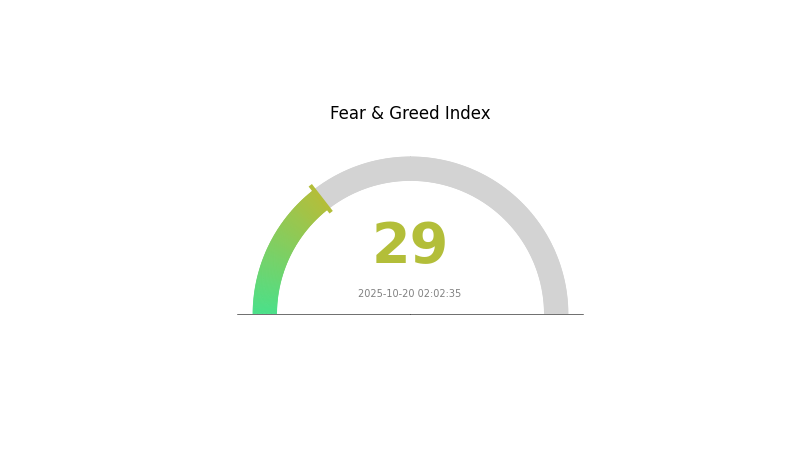

加密市场整体情绪由 VIX 指数 29 显示为恐慌,投资者情绪或影响 GRASS 价格表现。

点击查看当前 GRASS 市场价格

GRASS 市场情绪指标

2025-10-20 恐惧与贪婪指数:29(恐惧)

点击查看当前 恐惧与贪婪指数

加密市场目前处于恐慌情绪,恐惧与贪婪指数为 29,投资者态度谨慎,价值投资者或可寻求逆势布局机会。但市场情绪变动迅速,建议投资者充分调研,分散配置,并善用 Gate.com 等平台的风险管理工具,有效应对市场不确定性。

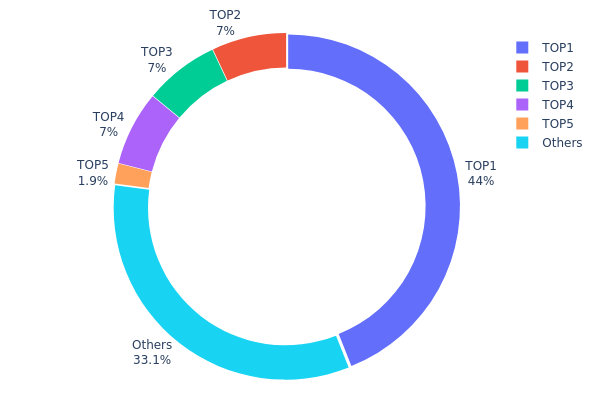

GRASS 持币分布

GRASS 地址持仓分布高度集中。最大地址持有总量的 44%,其后三大地址各占 7%,合计前四大共持有 65%。前五大地址合计持有近 67%,其余仅有约 33% 分布在其他用户手中。

如此集中分布引发市场稳定性与操控风险担忧。少数地址持有大部分通证,一旦大额抛售或协同行动,极易影响 GRASS 市场价格。高度中心化也反映出 GRASS 生态当前去中心化程度有限,背离区块链分布式理念。

目前分布结构显示 GRASS 市场尚不成熟,广泛用户和投资者参与度有限,短期内波动性和流动性风险较高,大户对市场影响较大。

点击查看当前 GRASS 持币分布

| Top | 地址 | 持有数量 | 持有比例 |

|---|---|---|---|

| 1 | 31rYar...8tLGqQ | 440017.61K | 44.00% |

| 2 | CMLjq7...Cqe8iP | 70000.00K | 7.00% |

| 3 | 8XWdMc...5gMUiX | 70000.00K | 7.00% |

| 4 | iauGQj...Mzmxjt | 70000.00K | 7.00% |

| 5 | 2Exsx4...6zko9T | 19000.00K | 1.90% |

| - | 其他 | 330976.94K | 33.1% |

二、影响 GRASS 未来价格的核心因素

供应机制

- 固定供应:GRASS 总量恒定,随需求增长将产生稀缺效应,有望推升价格。

- 历史经验:加密市场中,有限供应币种在需求上升时通常带动价格上涨。

- 现实影响:若 GRASS 应用与采用持续提升,固定供应有助于价格稳定甚至升值。

宏观环境

- 抗通胀属性:作为加密资产,GRASS 有望成为抗通胀配置,类似主流数字资产。

- 地缘政治:全球经济与地缘不确定性提升,对 GRASS 等另类资产配置需求增加。

技术发展与生态建设

- 生态应用:GRASS 生态内 DApp 和项目落地,有望提升实用性,进而刺激需求。

三、2025-2030 年 GRASS 价格预测

2025 年展望

- 保守预测:$0.22 - $0.33

- 中性预测:$0.33 - $0.43

- 乐观预测:$0.43 - $0.61(需市场环境极其有利)

2026-2027 年展望

- 市场阶段:逐步增长并趋稳

- 价格区间预测:

- 2026 年:$0.36 - $0.55

- 2027 年:$0.47 - $0.65

- 关键驱动:采用度提升及技术创新

2028-2030 年长期展望

- 基准情景:$0.59 - $0.76(假设市场稳步增长)

- 乐观情景:$0.76 - $0.88(假设市场表现优异)

- 变革性情景:$0.88 - $1.09(假设普及度极高且市场极度利好)

- 2030-12-31:GRASS $1.09(极端乐观下的潜在高点)

| 年份 | 预测最高价 | 预测均价 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.61109 | 0.4334 | 0.22103 | 0 |

| 2026 | 0.55358 | 0.52225 | 0.36557 | 19 |

| 2027 | 0.65626 | 0.53791 | 0.47874 | 23 |

| 2028 | 0.69859 | 0.59708 | 0.36422 | 37 |

| 2029 | 0.88106 | 0.64784 | 0.35631 | 48 |

| 2030 | 1.09316 | 0.76445 | 0.40516 | 75 |

四、GRASS 专业投资策略与风险管理

GRASS 投资策略

(1) 长线持有策略

- 适用对象:高风险承受能力的长期投资者

- 操作建议:

- 市场调整时分批布局

- 设定目标价,定期复盘配置

- 优先采用硬件钱包等高安全存储

(2) 主动交易策略

- 技术分析工具:

- 均线:判别趋势与反转

- RSI:识别超买/超卖区间

- 波段操作要点:

- 紧盯 Grass 网络相关市场动态与新闻

- 合理设置止损,控制风险敞口

GRASS 风险管理框架

(1) 资产配置原则

- 保守型:加密资产 1-3%

- 进取型:加密资产 5-10%

- 专业型:加密资产最高 15%

(2) 风险对冲措施

- 多元化:GRASS 与其他加密和传统资产平衡配置

- 止损:设置止损线限制亏损

(3) 安全存储方案

- 硬件钱包推荐:Gate Web3 钱包

- 软件钱包:Grass 官方钱包(如有)

- 安全措施:双重认证、强密码、私钥离线保存

五、GRASS 潜在风险与挑战

GRASS 市场风险

- 高波动:币价剧烈变动

- 竞争压力:其他带宽共享项目崛起

- 用户增长:Grass 生态扩张速度不及预期

GRASS 合规风险

- 监管不确定性:加密行业政策变化风险

- 跨境运营:不同国家法律环境差异

- 数据合规:带宽共享相关隐私监管风险

GRASS 技术风险

- 网络安全:Grass 网络潜在安全隐患

- 可扩展性:应对用户增长的技术挑战

- 智能合约:合约代码漏洞及安全攻击风险

六、结论与操作建议

GRASS 投资价值评估

GRASS 在带宽共享领域具备独特赛道价值,有望实现长期增长,但短期波动与监管风险不容忽视。

GRASS 投资建议

✅ 新手:建议小仓位试水,注重项目学习 ✅ 有经验者:建议均衡配置,动态调整持仓 ✅ 机构投资者:建议深入尽调,将 GRASS 纳入加密资产多元配置

GRASS 交易参与方式

- 现货交易:可在 Gate.com 直接买卖 GRASS

- 质押:如开放可参与相关质押项目

- 网络参与:通过 Grass 网络共享带宽赚取 GRASS 通证

加密货币投资风险极高,本文不构成投资建议。投资者应根据自身风险承受能力谨慎决策,并建议咨询专业金融顾问,切勿投入无法承受损失的资金。

常见问题

GRASS 通证未来价值多少?

预计 2025 年底 GRASS 通证价格将在 $0.15-$0.20 区间,主要受采用率提升和生态发展驱动。

GRASS 加密项目是否值得参与?

GRASS 项目具有发展潜力,正逐渐在 Web3 生态中获得认可,采用度提升,开发团队实力强劲。

GRT 有可能涨到 $10 吗?

GRT 若基本面持续强劲且 Web3 生态不断扩展,有望在 2025 年达到 $10,但需市场整体强势及 The Graph 协议稳步推进。

GRASS 当前价格是多少?

截至 2025 年 10 月,GRASS 均价约为 $0.75,整体呈现稳步上涨趋势。

2025 年 BLESS 价格预测:市场趋势分析与投资者前景展望

2025 年 HONEY 价格预测:甜蜜商品市场分析及未来趋势展望

Roam (ROAM) 是否具有投资价值?——深度解析这款数字游民代币的市场潜力与长期发展前景

Fluence(FLT)值得投资吗?——深度解析这一去中心化云计算平台的潜力与风险

Dimitra (DMTR) 是否值得投资?——农业区块链技术的前景与风险解析

2025 年 NODE 价格预测:后减半时代 NODE 代币的深度解析与市场前景

探索TAO:新手必读的交易所动态及代币购买指南

NBLU 简介:国家商法大学权威指南及其对法律教育的深远影响