2025 CRVPrice Prediction: Analyzing Market Trends, Adoption Metrics, and Key Factors Driving Curve DAO Token Valuation

Introduction: CRV's Market Position and Investment Value

Curve (CRV), as a decentralized exchange protocol for efficient stablecoin trading, has achieved significant milestones since its inception in 2020. As of 2025, Curve's market capitalization has reached $1.03 billion, with a circulating supply of approximately 1.4 billion tokens, and a price hovering around $0.7356. This asset, often hailed as the "stablecoin trading powerhouse," is playing an increasingly crucial role in the decentralized finance (DeFi) ecosystem.

This article will comprehensively analyze Curve's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. CRV Price History Review and Current Market Status

CRV Historical Price Evolution Trajectory

- 2020: Curve launched in January, price reached ATH of $15.37 on August 14

- 2021: Bull market cycle, CRV price experienced significant volatility

- 2022-2023: Crypto winter, price dropped from highs to lows

- 2024: Price hit ATL of $0.180354 on August 5

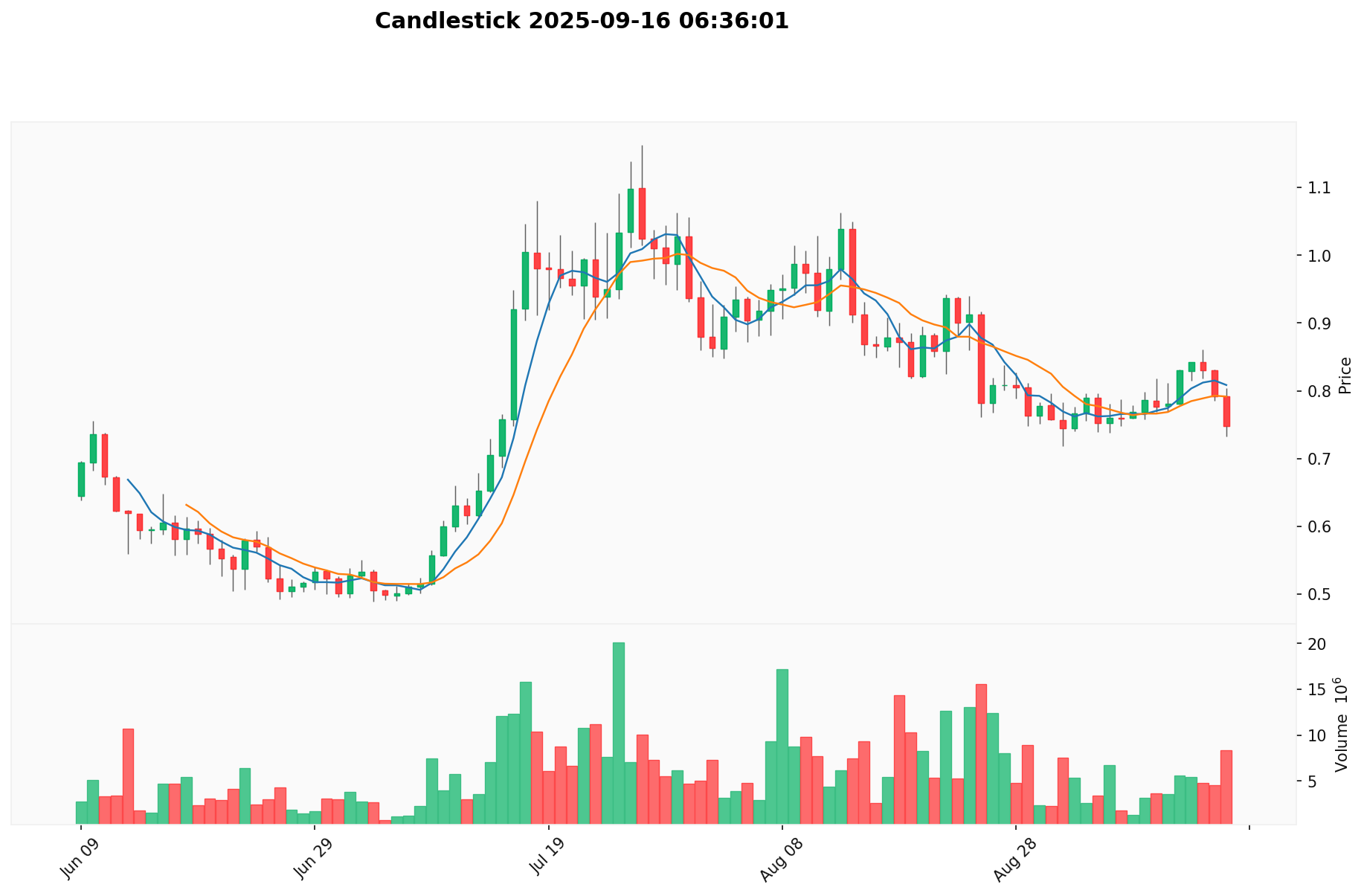

CRV Current Market Situation

As of September 16, 2025, CRV is trading at $0.7356, with a 24-hour trading volume of $5,877,317. The token has experienced a 7.82% decrease in the last 24 hours. CRV's market cap stands at $1,031,240,959, ranking it 110th in the overall cryptocurrency market. The circulating supply is 1,401,904,512 CRV, with a total supply of 2,304,788,327 and a max supply of 3,030,303,031 tokens.

CRV is currently down 95.21% from its all-time high of $15.37, but up 307.87% from its all-time low of $0.180354. The token has shown strong performance over the past year, with a 176.36% increase, despite recent short-term downtrends of -14.87% over the last 30 days and -7.39% over the past week.

Click to view the current CRV market price

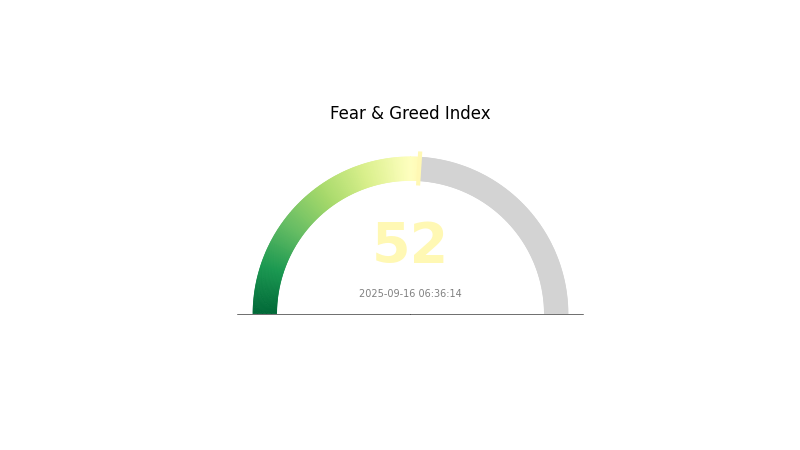

CRV Market Sentiment Indicator

2025-09-16 Fear and Greed Index: 52 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced as the Fear and Greed Index holds steady at 52, indicating a neutral outlook. This suggests that investors are cautiously optimistic, neither overly fearful nor excessively greedy. While market participants seem to be maintaining a level-headed approach, it's important to stay vigilant and monitor potential shifts in sentiment. As always, conducting thorough research and employing risk management strategies are crucial when navigating the crypto landscape.

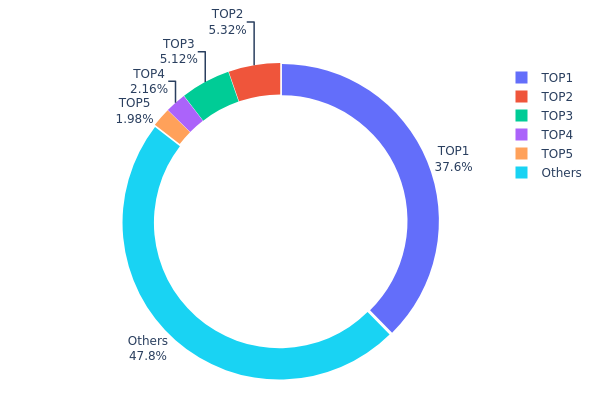

CRV Holdings Distribution

The address holdings distribution data for CRV reveals a significant concentration of tokens in a few top addresses. The largest holder possesses 37.61% of the total supply, while the top 5 addresses collectively control 52.15% of CRV tokens. This high concentration raises concerns about potential market manipulation and centralization risks.

Such a concentrated distribution could lead to increased price volatility and susceptibility to large-scale sell-offs if major holders decide to liquidate their positions. Moreover, it may impact governance decisions within the Curve ecosystem, as these large holders could exert disproportionate influence on protocol changes and upgrades.

Despite these concerns, it's worth noting that 47.85% of CRV tokens are held by addresses outside the top 5, indicating some level of distribution among smaller holders. This partial dispersion may provide a degree of stability and decentralization, albeit limited by the significant concentration at the top.

Click to view the current CRV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5f3b...94e2a2 | 866979.80K | 37.61% |

| 2 | 0xf977...41acec | 122609.42K | 5.31% |

| 3 | 0x5a52...70efcb | 118000.00K | 5.11% |

| 4 | 0x8fa1...984d4a | 49678.43K | 2.15% |

| 5 | 0xc06f...0b3370 | 45626.78K | 1.97% |

| - | Others | 1101858.07K | 47.85% |

II. Key Factors Affecting CRV's Future Price

Supply Mechanism

- Emission Schedule: CRV has a maximum supply of 3,030,303,030.299 tokens, with a current circulating supply of 1,389,745,746.69 tokens.

- Historical Patterns: The gradual release of tokens has historically impacted price as supply increases.

- Current Impact: With about 45.86% of the maximum supply in circulation, future emissions may continue to exert downward pressure on price.

Institutional and Whale Dynamics

- Institutional Holdings: Framework Ventures and Alameda Research are known portfolio holders of CRV.

- Enterprise Adoption: Curve Finance's platform is widely used in the DeFi ecosystem, indirectly affecting CRV demand.

Macroeconomic Environment

- Inflation Hedging Properties: As a DeFi token, CRV may be viewed as a potential hedge against inflation, similar to other cryptocurrencies.

Technical Development and Ecosystem Building

- Platform Upgrades: Continuous improvements to the Curve Finance platform can positively impact CRV's value.

- Ecosystem Applications: Curve Finance is a key player in the DeFi space, particularly for stablecoin trading and liquidity provision.

III. CRV Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.57631 - $0.65

- Neutral prediction: $0.65 - $0.75

- Optimistic prediction: $0.75 - $0.80975 (requires favorable market conditions and increased DeFi adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.73422 - $0.87291

- 2028: $0.72614 - $1.19898

- Key catalysts: DeFi ecosystem expansion, improved scalability, and broader institutional adoption

2030 Long-term Outlook

- Base scenario: $0.90 - $1.20 (assuming steady growth in DeFi and crypto markets)

- Optimistic scenario: $1.20 - $1.50 (with accelerated DeFi integration and favorable regulatory environment)

- Transformative scenario: $1.50 - $1.68212 (with breakthrough innovations in DeFi and widespread mainstream adoption)

- 2030-12-31: CRV $1.12894 (potential average price based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.80975 | 0.7295 | 0.57631 | 0 |

| 2026 | 0.86198 | 0.76962 | 0.67727 | 4 |

| 2027 | 0.87291 | 0.8158 | 0.73422 | 10 |

| 2028 | 1.19898 | 0.84435 | 0.72614 | 14 |

| 2029 | 1.23622 | 1.02167 | 0.56192 | 38 |

| 2030 | 1.68212 | 1.12894 | 0.67737 | 53 |

IV. Professional CRV Investment Strategies and Risk Management

CRV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and DeFi enthusiasts

- Operation suggestions:

- Accumulate CRV tokens during market dips

- Participate in Curve governance to earn additional rewards

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Curve TVL and trading volume trends

- Stay updated on Curve protocol upgrades and partnerships

CRV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi protocols

- Options strategies: Use CRV options to hedge downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and backup private keys

V. Potential Risks and Challenges for CRV

CRV Market Risks

- Volatility: CRV price can experience significant fluctuations

- Competition: Emerging DEX protocols may challenge Curve's market share

- Liquidity risks: Sudden liquidity withdrawals could impact token price

CRV Regulatory Risks

- Unclear regulations: DeFi protocols may face increased scrutiny

- Compliance requirements: Potential need for KYC/AML implementation

- Tax implications: Evolving tax laws for DeFi participation

CRV Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability challenges: Ethereum network congestion may impact Curve

- Oracle failures: Inaccurate price feeds could disrupt protocol operations

VI. Conclusion and Action Recommendations

CRV Investment Value Assessment

CRV presents a compelling long-term value proposition as a leading DeFi protocol, but faces short-term risks from market volatility and regulatory uncertainty.

CRV Investment Recommendations

✅ Beginners: Start with small positions, focus on learning Curve mechanics

✅ Experienced investors: Consider active participation in Curve governance

✅ Institutional investors: Explore yield farming strategies and liquidity provision

CRV Participation Methods

- Token holding: Purchase and hold CRV for potential appreciation

- Liquidity provision: Supply assets to Curve pools to earn fees and rewards

- Governance participation: Stake CRV to vote on protocol proposals

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Will CRV reach $1?

Yes, CRV is projected to reach $1 by 2025. Forecasts indicate it may even exceed this value, with predictions suggesting a potential peak of $1.20.

Is CRV worth investing in?

CRV's potential depends on market trends. Current projections are uncertain, but it may offer value if technical signals improve. Consider updated data for informed decisions.

Is CRV a good token?

CRV is a leading DeFi token with strong growth potential. It plays a crucial role in liquidity pools and has favorable long-term prospects.

Will CRV recover?

CRV's recovery is possible but uncertain. Market trends and on-chain data suggest a potential rebound, but timing remains unclear.

2025 CRVPrice Prediction: Analyzing Market Trends and Future Potential of the Curve DAO Token

2025 LUNA Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Recovery Era

What is WNXM: Understanding the Wrapped Nexus Mutual Token and Its Role in DeFi Insurance

What is TRWA: The Revolutionary Workforce Algorithm Transforming Modern Business Operations

2025 RESOLV Price Prediction: Analyzing Market Trends and Future Valuation Potential

ENA vs CRO: A Comparative Analysis of Two Leading Genomic Data Repositories

Understanding ERC 6551: A Comprehensive Guide to the Token Standard

Top Solutions for Safely Storing Polygon NFTs

Secure Strategies for Managing Your Wallet's Private Key

Unlocking DeFi: A Comprehensive Guide to Flash Loan Arbitrage Opportunities

Mastering Margin Trading in Cryptocurrency Markets