2025 CHR Price Prediction: Expert Analysis and Market Forecast for Chromia Token

Introduction: CHR Market Position and Investment Value

Chromia (CHR) is a blockchain platform designed for decentralized applications, combining blockchain technology with relational database capabilities to enable dapps to scale beyond current limitations. Since its launch in 2019, Chromia has established itself as a unique infrastructure solution for developers worldwide. As of December 2025, CHR boasts a market capitalization of approximately $32.83 million with a circulating supply of around 850.18 million tokens, currently trading at $0.03862 per token. This innovative asset, recognized as a "blockchain-database hybrid," is increasingly playing a critical role in enabling decentralized applications to function with familiar programming paradigms that enterprise developers understand.

This comprehensive analysis examines CHR price trajectories through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors seeking exposure to this emerging blockchain infrastructure platform.

Chromia (CHR) Market Analysis Report

I. CHR Price History Review and Current Market Status

CHR Historical Price Evolution

-

2021: Chromia reached its all-time high (ATH) of $1.49 on November 20, 2021, representing the peak of market enthusiasm during the broader cryptocurrency bull market of that period.

-

2020-2025: From the all-time low (ATL) of $0.00874003 recorded on March 13, 2020, CHR has experienced significant volatility. The token has since declined dramatically, with a year-over-year loss of -84.55%, reflecting substantial retracement from peak valuations.

CHR Current Market Landscape

As of December 19, 2025, Chromia (CHR) is trading at $0.03862, representing a significant markdown from historical highs. The token exhibits the following market characteristics:

Price Performance Metrics:

- 1-hour change: +0.10%

- 24-hour change: -4.04%

- 7-day change: -26.47%

- 30-day change: -37.26%

- 1-year change: -84.55%

Market Capitalization and Supply:

- Market capitalization: $32,834,025.53

- Fully diluted valuation (FDV): $32,834,025.53

- Circulating supply: 850,181,914.378197 CHR (86.92% of total supply)

- Total supply: 850,181,914.378197 CHR

- Maximum supply: 978,064,789 CHR

- Market dominance: 0.0010%

Trading Activity:

- 24-hour trading volume: $20,060.99

- 24-hour high: $0.042

- 24-hour low: $0.03715

- Active holders: 10,282

- Listed on 32 cryptocurrency exchanges

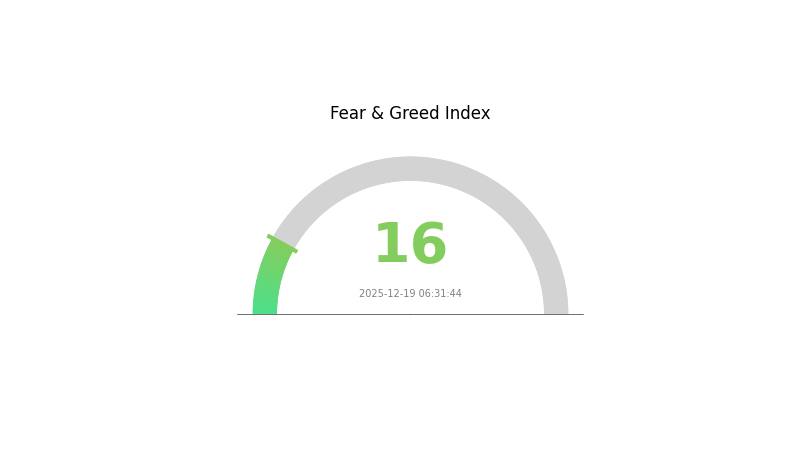

Market Sentiment: Current market sentiment reflects "Extreme Fear," indicating heightened bearish conditions in the broader cryptocurrency market environment.

Click to view current CHR market price

CHR Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index dropping to 16. This reading reflects significant market pessimism and heightened risk aversion among investors. During such phases, market volatility tends to increase as traders reassess positions and risk exposure. While extreme fear can present contrarian opportunities for long-term investors, it also signals potential for continued downside pressure in the near term. Market participants should exercise caution and implement proper risk management strategies. Monitor key support levels and maintain disciplined portfolio management on Gate.com.

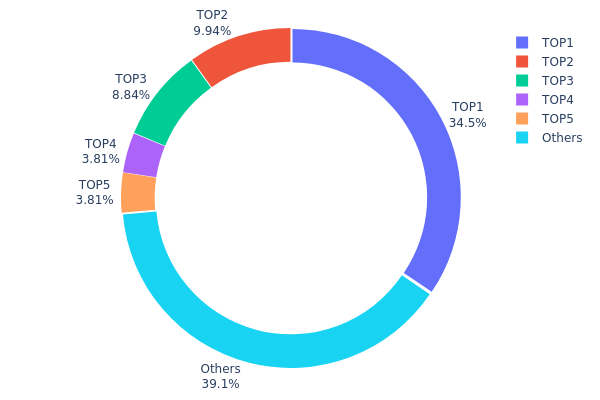

CHR Holdings Distribution

The address holdings distribution map illustrates the concentration of CHR tokens across the blockchain network's top holders and the broader market participants. This metric provides critical insights into token ownership patterns, revealing the degree of centralization and potential market concentration risks. By analyzing the top addresses and their respective holdings percentages, market participants can assess liquidity dynamics, voting power concentration, and vulnerability to large-scale sell-offs.

CHR demonstrates notable concentration characteristics within its current holder base. The top address commands 34.50% of total supply, while the combined top five addresses control approximately 60.89% of all circulating tokens. This level of concentration indicates significant centralization risk, as a majority of the token supply is held by a limited number of wallet addresses. The remaining 39.11% dispersed among other addresses suggests a fragmented secondary market structure, though this distribution is substantially outweighed by the dominant position of the leading holders.

The pronounced concentration at the top tier presents several implications for market structure and price dynamics. Large holders possess considerable influence over trading volumes and price discovery mechanisms, with the potential to execute substantial transactions that could trigger significant volatility. The unequal distribution raises considerations regarding organic market development and retail participation, as the ability to influence market movements is concentrated among a small cohort of addresses. This structural imbalance suggests that CHR's decentralization profile remains limited, with chain-level governance heavily weighted toward the largest stakeholders.

Click to view current CHR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 198734.43K | 34.50% |

| 2 | 0x5a52...70efcb | 57254.38K | 9.94% |

| 3 | 0x28c6...f21d60 | 50903.71K | 8.83% |

| 4 | 0xf567...21a32f | 21950.49K | 3.81% |

| 5 | 0xc7b0...ab863b | 21949.07K | 3.81% |

| - | Others | 225173.33K | 39.11% |

II. Core Factors Influencing CHR's Future Price

Market Sentiment and Adoption

-

Investor Confidence: Market sentiment and investor confidence have a direct impact on CHR price movements. Positive news regarding widespread CHR adoption or major technological breakthroughs can drive significant price appreciation, while negative sentiment can lead to sharp declines.

-

User Adoption Rate: The level of user adoption and platform utilization plays a crucial role in determining CHR's long-term value trajectory.

Macroeconomic Environment

-

Monetary Policy Impact: CHR's price is influenced by overall economic trends and regulatory policies at the macroeconomic level, affecting its market valuation.

-

Market Demand Dynamics: Price volatility is significantly driven by market demand fluctuations and the overall investment sentiment within the cryptocurrency sector.

Technology Innovation and Ecosystem Development

-

Artificial Intelligence Integration: The convergence of AI and blockchain technology is expected to have a notable impact on the market, with potential implications for CHR's ecosystem expansion and long-term growth prospects.

-

Token Utility and Economics: The token's practical utility within the Chromia ecosystem and its underlying economic model are fundamental drivers of its value proposition and future appreciation potential.

III. 2025-2030 CHR Price Forecast

2025 Outlook

- Conservative Forecast: $0.02242 - $0.03865

- Base Case Forecast: $0.03865

- Optimistic Forecast: $0.04252 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with moderate volatility, characterized by incremental adoption and strengthening fundamental support.

- Price Range Predictions:

- 2026: $0.02922 - $0.05722

- 2027: $0.04401 - $0.05379

- Key Catalysts: Ecosystem expansion, increased institutional interest, platform integrations, and overall market sentiment improvement in the broader cryptocurrency sector.

2028-2030 Long-term Outlook

- Base Scenario: $0.05135 - $0.06726 (assumes steady technological progress and measured market growth)

- Optimistic Scenario: $0.06968 - $0.08711 (assumes accelerated adoption and strong market cycle conditions)

- Transformation Scenario: $0.08711+ (assumes breakthrough network effects, major partnership announcements, and favorable macroeconomic conditions)

- December 19, 2030: CHR projects potential upside of approximately 80% from current levels (indicating significant long-term appreciation potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04252 | 0.03865 | 0.02242 | 0 |

| 2026 | 0.05722 | 0.04058 | 0.02922 | 5 |

| 2027 | 0.05379 | 0.0489 | 0.04401 | 26 |

| 2028 | 0.06726 | 0.05135 | 0.02773 | 32 |

| 2029 | 0.08006 | 0.05931 | 0.03973 | 53 |

| 2030 | 0.08711 | 0.06968 | 0.04181 | 80 |

Chromia (CHR) Professional Investment Strategy and Risk Management Report

IV. CHR Professional Investment Strategy and Risk Management

CHR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Technology-focused investors with high risk tolerance and long-term investment horizons who believe in Chromia's blockchain infrastructure potential

- Operational Recommendations:

- Accumulate CHR during market downturns, particularly given the -84.55% annual decline, which may present entry opportunities for believers in the project's fundamentals

- Set realistic price targets based on the historical all-time high of $1.49 and reassess project developments quarterly

- Maintain position through multiple market cycles to benefit from potential protocol upgrades and dApp ecosystem growth on the Chromia platform

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price levels at $0.03715 (24h low) and $0.042 (24h high) for trade entry and exit points

- Moving Averages: Use 50-day and 200-day moving averages to identify trend direction and momentum shifts in CHR price action

- Range Trading Key Points:

- Monitor the $0.03862 current price level relative to historical volatility patterns to identify potential reversal zones

- Execute buy orders near support levels and sell orders near resistance, considering the -26.47% 7-day decline suggests recent selling pressure

CHR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of portfolio allocation, due to CHR's high volatility and market cap ranking of 651

- Active Investors: 1-3% of portfolio allocation, with dollar-cost averaging to mitigate timing risk

- Professional Investors: 2-5% of portfolio allocation, with hedging strategies and portfolio rebalancing protocols

(2) Risk Hedging Solutions

- Stablecoin Pairing Strategy: Maintain USDT or USDC holdings equivalent to 50% of CHR positions to quickly reduce exposure during sharp declines

- Portfolio Diversification: Balance CHR holdings with other blockchain infrastructure projects to reduce single-asset concentration risk

(3) Secure Storage Solutions

- Cold Storage Best Practices: Transfer CHR tokens to secure hardware wallets for holdings exceeding $5,000, maintaining private keys offline

- Exchange Custody: Use Gate.com for active trading positions, leveraging the platform's insurance and security protocols for amounts under active management

- Security Precautions: Enable two-factor authentication, use IP whitelisting, never share private keys, and regularly audit wallet access logs

V. CHR Potential Risks and Challenges

CHR Market Risks

- Liquidity Risk: With 24-hour volume of only $20,060.99 against a $32.8M market cap, liquidity is constrained, potentially causing significant slippage on large trades

- Price Volatility: The -37.26% 30-day decline and -84.55% annual loss demonstrate extreme volatility, exposing investors to rapid and substantial value losses

- Market Adoption Risk: As a Layer 1 blockchain competing against established platforms, Chromia faces significant hurdles in attracting developers and users to its ecosystem

CHR Regulatory Risks

- Regulatory Uncertainty: Blockchain platforms face evolving regulatory frameworks globally, with potential restrictions on token trading or platform operations in major jurisdictions

- Compliance Risk: Changes in securities regulations could impact how Chromia tokens are classified and traded across different markets

- Enforcement Actions: Regulatory bodies may implement stricter oversight of decentralized application platforms, affecting Chromia's operational framework

CHR Technical Risks

- Smart Contract Vulnerability: As a blockchain platform supporting dApps, Chromia faces potential vulnerabilities in its protocol code that could be exploited by attackers

- Database Integration Risk: The dual nature of Chromia as both blockchain and relational database creates complex technical dependencies that could introduce failures

- Network Scalability: Achieving widespread adoption requires proving the platform can handle enterprise-level transaction volumes without degradation

VI. Conclusion and Action Recommendations

CHR Investment Value Assessment

Chromia presents an interesting but high-risk proposition in the competitive blockchain infrastructure space. While the platform's unique combination of blockchain technology with relational database functionality addresses real scalability challenges for decentralized applications, the token faces significant headwinds: a 651st market cap ranking, severe price depreciation over multiple time frames, and limited trading liquidity. The project's viability depends heavily on successful dApp ecosystem development and wider adoption of the Chromia platform. Current price levels may represent opportunities for risk-tolerant investors with extended time horizons, but the substantial annual decline suggests cautious market sentiment about near-term prospects.

CHR Investment Recommendations

✅ Beginners: Start with micro-positions (0.1-0.5% portfolio allocation) on Gate.com through dollar-cost averaging over 3-6 months, allowing you to learn platform mechanics while limiting downside exposure

✅ Experienced Investors: Consider 1-3% portfolio allocation with technical analysis-driven entry points near support levels; maintain tight stop-losses at -15% to 20% below entry prices

✅ Institutional Investors: Conduct thorough due diligence on Chromia's development roadmap and dApp partnerships before considering strategic positions; establish hedging protocols and liquidity management plans

CHR Trading Participation Methods

- Spot Trading on Gate.com: Execute buy/sell orders at market or limit prices for direct token acquisition, ideal for long-term holders seeking straightforward exposure

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals (weekly or monthly) to reduce the impact of price volatility and improve average entry costs

- Limit Orders Strategy: Place orders at predetermined price levels below current market prices, allowing disciplined entry during natural pullbacks without requiring constant monitoring

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors must carefully consider their individual risk tolerance, investment objectives, and financial circumstances before making any decisions. Always consult with qualified financial advisors and never invest more than you can afford to lose.

FAQ

What is Chr's all-time high price?

Chr's all-time high price was $1.49, reached in the past. The cryptocurrency has since experienced significant price decline from this peak level.

Does Cronos Coin have a future?

Yes, Cronos Coin shows strong potential with active development and EVM compatibility. Its integration with major platforms and ongoing ecosystem expansion suggest promising long-term prospects for growth and adoption.

How much will Cronos cost in 2030?

Cronos is expected to reach approximately $5.94 by December 2030, with a price range between $6.36 and $5.52 throughout the year based on market analysis.

What is the future of chromia coin?

Chromia coin is projected to reach $0.058934 by 2030 and $0.15637 by 2050. Based on market analysis and adoption trends, CHR shows potential growth as blockchain infrastructure demand increases.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Custodial vs Non-Custodial Crypto Wallets: Key Differences Explained

Exploring Travel Insurance Options with Cryptocurrency Coverage

Understanding How Digital Lending Networks Operate

Exploring Polygon's Expanding Network of Collaborations and Integrations

What is GFI: A Comprehensive Guide to Global Financial Intelligence and Its Applications in Modern Business