2025 BNSX Price Prediction: Analyzing Market Trends and Expert Forecasts for the Cryptocurrency's Future Value

Introduction: BNSX's Market Position and Investment Value

BNSx (BNSX), as a decentralized identity solution and short domain service for the Web3 and Bitcoin ecosystems, has been making significant strides since its inception. As of 2025, BNSX's market capitalization has reached $132,741, with a circulating supply of 21,000,000 tokens and a price hovering around $0.006321. This asset, often referred to as the "Bitcoin Name Service System," is playing an increasingly crucial role in addressing the growing need for decentralized identity solutions within the Web3 and Bitcoin ecosystems.

This article will provide a comprehensive analysis of BNSX's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BNSX Price History Review and Current Market Status

BNSX Historical Price Evolution

- 2023: Project launch, price reached an all-time high of $2.4798 on December 19

- 2024: Market fluctuations, price experienced significant volatility

- 2025: Bearish trend, price dropped to an all-time low of $0.004901 on October 11

BNSX Current Market Situation

As of November 1, 2025, BNSX is trading at $0.006321. The token has experienced a significant decline over the past year, with a 86.52% decrease in value. In the last 24 hours, BNSX has seen a 13.65% drop, indicating continued bearish pressure. The trading volume in the past 24 hours stands at $10,035.25, with a market capitalization of $132,741. BNSX currently ranks #4761 in the cryptocurrency market, holding a market share of 0.0000033%. The circulating supply matches the total supply of 21,000,000 BNSX tokens.

Click to view the current BNSX market price

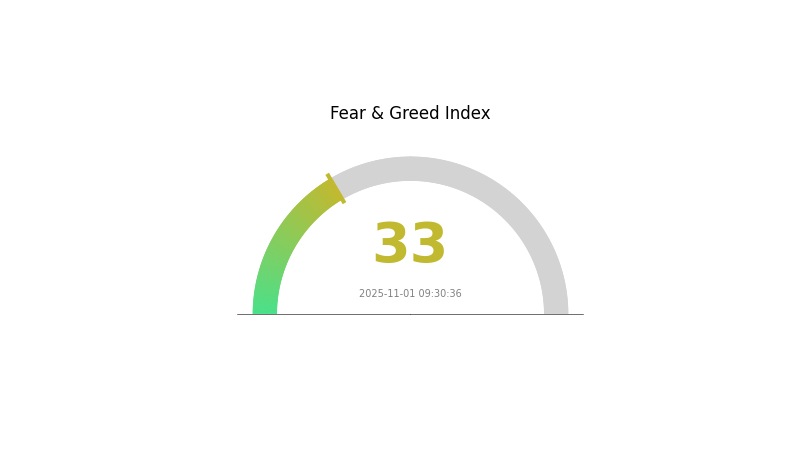

BNSX Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the sentiment index registering at 33. This indicates a cautious atmosphere among investors, potentially presenting buying opportunities for those willing to go against the prevailing mood. However, it's crucial to remember that market sentiment can shift rapidly. Traders should remain vigilant, conduct thorough research, and consider diversifying their portfolios to mitigate risks. As always, it's advisable to use reputable platforms like Gate.com for secure trading and stay informed about market trends.

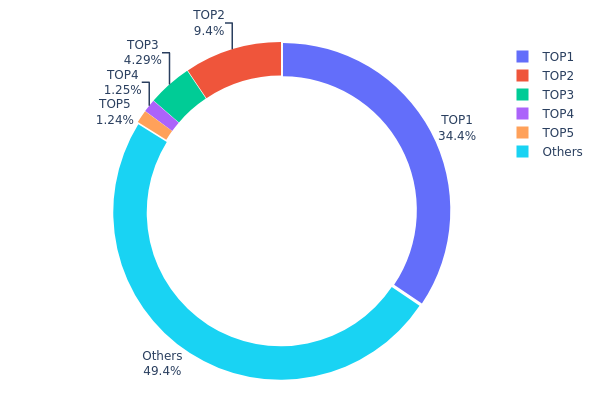

BNSX Holdings Distribution

The address holdings distribution data for BNSX reveals significant concentration among top holders. The largest address controls 34.40% of the total supply, while the top 5 addresses collectively hold 50.57% of BNSX tokens. This high concentration raises concerns about potential market manipulation and price volatility.

Such a centralized distribution structure could impact market dynamics, as large holders have the ability to significantly influence token prices through their trading activities. The concentration of power in a few addresses may also affect the overall decentralization and governance of the BNSX ecosystem.

Despite these concerns, it's worth noting that nearly half (49.43%) of BNSX tokens are distributed among other addresses, indicating some level of broader market participation. However, the current distribution suggests a need for increased token dispersion to enhance market stability and reduce manipulation risks.

Click to view the current BNSX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 16G1xY...Vp9Wxh | 7225.19K | 34.40% |

| 2 | 16vNcv...hVyMAC | 1974.50K | 9.40% |

| 3 | 3MGWfd...8wDF7a | 900.00K | 4.28% |

| 4 | 1Dho5g...ruQEAJ | 263.09K | 1.25% |

| 5 | bc1pj5...vhc97y | 260.46K | 1.24% |

| - | Others | 10376.76K | 49.43% |

II. Key Factors Affecting BNSX's Future Price

Supply Mechanism

- Market Demand: The price of BNSX is influenced by market demand and trading volume.

- Current Impact: Investors should closely monitor market changes to anticipate potential price movements.

Institutional and Whale Dynamics

- Corporate Adoption: The approval probability of Bitcoin spot ETFs is a major factor driving cryptocurrency prices upward.

Macroeconomic Environment

- Geopolitical Factors: Market sentiment plays a crucial role in determining BNSX's price trajectory.

Technological Development and Ecosystem Building

- Ecosystem Applications: Gate.com is mentioned as a significant trading platform for BNSX, indicating its importance in the ecosystem.

III. BNSX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00417 - $0.00631

- Neutral prediction: $0.00631 - $0.00675

- Optimistic prediction: $0.00675 - $0.00719 (requires positive market sentiment)

2026-2028 Outlook

- Market phase expectation: Gradual growth with potential volatility

- Price range forecast:

- 2026: $0.00371 - $0.00702

- 2027: $0.00448 - $0.00902

- 2028: $0.00716 - $0.01034

- Key catalysts: Increased adoption, technological improvements, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00915 - $0.01038 (assuming steady market growth)

- Optimistic scenario: $0.01038 - $0.01162 (assuming strong market performance)

- Transformative scenario: $0.01162 - $0.0136 (assuming breakthrough developments and mass adoption)

- 2030-12-31: BNSX $0.0136 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00719 | 0.00631 | 0.00417 | 0 |

| 2026 | 0.00702 | 0.00675 | 0.00371 | 6 |

| 2027 | 0.00902 | 0.00689 | 0.00448 | 8 |

| 2028 | 0.01034 | 0.00796 | 0.00716 | 25 |

| 2029 | 0.01162 | 0.00915 | 0.00805 | 44 |

| 2030 | 0.0136 | 0.01038 | 0.00696 | 64 |

IV. BNSX Professional Investment Strategies and Risk Management

BNSX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate BNSX during market dips

- Set a target exit price or timeframe

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders

- Take profits at predetermined levels

BNSX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BNSX

BNSX Market Risks

- High volatility: BNSX price can experience significant fluctuations

- Low liquidity: Limited trading volume may impact entry and exit strategies

- Competition: Other Bitcoin-based naming services may emerge

BNSX Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on BRC-20 tokens

- Legal status: Unclear classification of BNSX tokens in various jurisdictions

- Tax implications: Evolving tax laws may affect BNSX transactions and holdings

BNSX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability issues: Limitations of the Bitcoin network may impact BNSX functionality

- Adoption challenges: Slow uptake of the naming service could hinder growth

VI. Conclusion and Action Recommendations

BNSX Investment Value Assessment

BNSX offers potential long-term value as a decentralized naming service for the Bitcoin ecosystem. However, short-term risks include high volatility, regulatory uncertainties, and technical challenges.

BNSX Investment Recommendations

✅ Beginners: Consider small, experimental positions with strict risk management ✅ Experienced investors: Implement a dollar-cost averaging strategy with regular reviews ✅ Institutional investors: Conduct thorough due diligence and consider BNSX as part of a diversified crypto portfolio

BNSX Trading Participation Methods

- Spot trading: Buy and sell BNSX on Gate.com

- Limit orders: Set predetermined buy and sell prices to automate trading

- DCA strategy: Regularly purchase small amounts of BNSX to average out price volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will CNS coin reach $1?

It's highly unlikely CNS will reach $1. Current market trends don't support this price target, but long-term potential remains uncertain.

Can BNB reach $1000 USD?

Yes, BNB has strong potential to reach $1000 USD. With its current momentum and positive market trends, analysts predict BNB could hit $1060-$1080 in the near future.

Will BNB reach $10,000?

Reaching $10,000 for BNB is highly unlikely. Current market trends don't support such a massive price increase by 2025.

How much will 1 BNB be worth in 2025?

Based on long-term forecasts, 1 BNB is expected to be worth around $1,088 on average in 2025, with a potential minimum price of $1,059.

2025 BNSX Price Prediction: Bullish Outlook as Adoption Accelerates

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Jack Dorsey's Net Worth in 2025: Crypto Investments and Web3 Impact

How Many Nodes in Bitcoin

How Did Dan Bilzerian Make His Money

What Does BTC Mean in Text

Rivalz Network Token: Comprehensive Guide to RIZ Listing, Market Insights, and Purchase Steps

AI-Driven Play-to-Earn Puzzle Platform on Blockchain

SWEAT vs LINK: Comprehensive Comparison of Two Rising Blockchain Tokens in the Crypto Market

Is Gearbox (GEAR) a good investment?: A Comprehensive Analysis of the DeFi Protocol's Potential and Risks

Is Synapse (SYN) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Opportunities in 2024