2025 BAS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: BAS Market Position and Investment Value

BNB Attestation Service (BAS), as the native verification and reputation layer on BNB Chain, has emerged as a critical infrastructure component since its launch in January 2025. As of December 2025, BAS boasts a market capitalization of $60,050,000 with a circulating supply of 2.5 billion tokens, trading at approximately $0.006005. This innovative asset, recognized for its role in enabling composable on-chain KYC, identity, and asset verification, is increasingly playing a key role in powering real-world asset (RWA) tokenization, decentralized finance (DeFi), and AI agent ecosystems.

This article will comprehensively analyze BAS's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for discerning investors.

BNB Attestation Service (BAS) Market Analysis Report

I. BAS Price History Review and Current Market Status

BAS Historical Price Evolution

-

October 2025: BAS reached its all-time high of $0.17051 on October 17, 2025, marking a significant peak in early trading activity following the token's launch.

-

December 2025: BAS experienced a substantial decline, hitting its all-time low of $0.00385 on December 11, 2025, representing a correction of approximately 77.4% from the peak value within a two-month period.

BAS Current Market Situation

As of December 21, 2025, BAS is trading at $0.006005, reflecting a modest recovery from its December lows. The token has demonstrated notable volatility characteristics:

Short-term Price Movements:

- 1-hour change: -1.63% (down $0.000099503)

- 24-hour change: -1.29% (down $0.000078477)

- 7-day change: -0.05% (down $0.000003004)

Medium to Long-term Performance:

- 30-day change: +6.98% (up $0.000391801)

- 1-year change: +42.63% (up $0.001794806)

Market Metrics:

- Market capitalization: $15,012,500

- Fully diluted valuation (FDV): $60,050,000

- Circulating supply: 2,500,000,000 BAS (25% of total supply)

- Total supply: 10,000,000,000 BAS

- 24-hour trading volume: $213,947.41

- Number of holders: 198,645

- Market share: 0.0018%

- Trading on 11 major exchanges

Market Sentiment: The current market sentiment reflects extreme fear (VIX: 20), indicating heightened risk aversion across the broader cryptocurrency market, which may be influencing BAS trading dynamics.

Recent Trading Range:

- 24-hour high: $0.006367

- 24-hour low: $0.005365

Visit current BAS market price

BAS Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates widespread investor anxiety and pessimistic market sentiment. When the index reaches such low levels, it typically signals excessive bearish pressure and potential capitulation. Historically, extreme fear periods have presented buying opportunities for long-term investors, as assets may be oversold. However, traders should exercise caution and conduct thorough research before entering positions. Consider using dollar-cost averaging strategies to mitigate risk during such volatile periods.

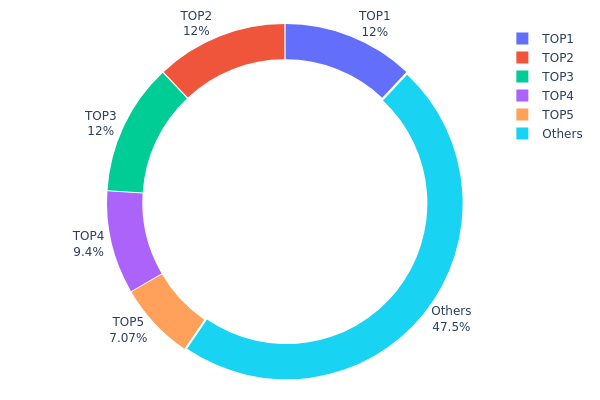

BAS Holdings Distribution

The address holdings distribution chart provides a detailed breakdown of token concentration across blockchain addresses, revealing the ownership structure and potential market concentration risk. By analyzing the top holders and their proportional stake in total circulating supply, this metric offers critical insights into the decentralization level and vulnerability to potential market manipulation.

Current data indicates that BAS exhibits moderate concentration characteristics. The top five addresses collectively control approximately 52.48% of total holdings, with the leading address (0x1f91...e15ef2) holding 12.01% and the second-largest position (0xecd5...a5275f) holding 12.00%. Notably, the remaining addresses classified as "Others" represent 47.52% of all holdings, suggesting a reasonably distributed ownership structure beyond the top tier holders. While the top five addresses do command a significant portion of the token supply, no single entity demonstrates overwhelming dominance, and the concentration remains within acceptable ranges for tokens in mature development phases.

The current distribution pattern reflects a relatively balanced market microstructure with limited acute manipulation risks. The substantial "Others" category, comprising nearly half of all holdings, indicates that the BAS token maintains adequate decentralization to support stable price discovery and reduce systemic vulnerability to coordinated selling pressure from top holders. This distribution profile suggests moderate on-chain structural stability, where price movements are likely influenced by broader market sentiment and utility adoption rather than concentrated whale activity. The fragmented ownership among numerous smaller holders contributes to improved ecosystem resilience and suggests growing institutional and retail participation in the BAS ecosystem.

For current BAS holdings distribution data, please visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1f91...e15ef2 | 300242.69K | 12.01% |

| 2 | 0xecd5...a5275f | 300000.04K | 12.00% |

| 3 | 0xf61b...f020ba | 300000.00K | 12.00% |

| 4 | 0x1536...e66c80 | 235000.00K | 9.40% |

| 5 | 0x73d8...4946db | 176795.47K | 7.07% |

| - | Others | 1187727.51K | 47.52% |

Analysis of Core Factors Affecting BAS Future Price

II. Core Factors Impacting BAS Future Price

Market Liquidity and Trading Depth

-

Exchange Trading Depth: Trading depth and transaction volume on major cryptocurrency exchanges directly influence BAS price stability. Strong liquidity ensures smoother price discovery and reduces slippage during large trades.

-

Market Volatility: As demonstrated in recent market movements, BAS experienced significant price appreciation (over 50% in 24-hour periods during December 2025), indicating sensitivity to market-wide sentiment shifts and liquidity conditions.

BNB Ecosystem Development

-

New Applications Deployment: The launch of new applications on the BNB chain and increased user activity directly drive demand for BAS tokens. Ecosystem expansion creates sustained use cases for the token.

-

User Activity Growth: Enhanced user engagement across the BNB ecosystem translates into higher transaction volumes, which can positively impact BAS utility and demand.

Token Unlock Schedule Design

-

Supply Concentration Risk: Poorly designed token unlock schedules can cause significant price volatility. Concentrated unlocks introduce large supply surges that markets struggle to absorb, typically resulting in sharp price declines.

-

Optimal Unlock Structure: Linear vesting with cliff periods provides market stability. A recommended approach includes a 12-month cliff followed by 36-month linear releases, allowing gradual market absorption of new token supply. Different stakeholder categories (team, investors, community) should maintain differentiated unlock schedules based on their contribution timing and risk profiles.

-

Transparency Requirements: On-chain lock contracts and publicly disclosed unlock schedules enable community monitoring and reduce trust risks associated with sudden large sells.

Macroeconomic Environment

-

Monetary Policy Effects: Federal Reserve policy decisions significantly influence cryptocurrency market sentiment. Rate cuts may provide tailwinds for risk assets like BAS, though the relationship is nuanced—policy outcomes depend on underlying economic rationales rather than simple rate direction.

-

Market Sentiment Cycles: Investor behavior shifts between speculative and fundamentals-driven trading, particularly visible in rotation from Meme token sectors toward projects with technical narratives and ecosystem value.

III. 2025-2030 BAS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00372 - $0.00591

- Base Case Forecast: $0.00591

- Optimistic Forecast: $0.00756 (requires market recovery and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and gradual growth phase with consolidation periods

- Price Range Predictions:

- 2026: $0.00654 - $0.00963

- 2027: $0.00467 - $0.01171

- 2028: $0.00716 - $0.01104

- Key Catalysts: Protocol upgrades, ecosystem expansion, institutional adoption, and improving market sentiment in the broader cryptocurrency sector

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00860 - $0.01049 in 2029, reaching $0.00781 - $0.01259 in 2030 (assumes steady ecosystem development and moderate market growth)

- Optimistic Scenario: $0.01104 - $0.01469 in 2029, with potential to reach $0.01561 in 2030 (assumes accelerated adoption and positive market conditions)

- Bull Case Scenario: $0.01561 or higher by 2030 (assumes transformative partnerships, major protocol breakthroughs, or substantial increase in DeFi sector participation)

Note: These projections represent technical analysis-based forecasts. Investors should conduct thorough due diligence and monitor BAS token developments on platforms such as Gate.com before making investment decisions. Cryptocurrency markets remain highly volatile and subject to rapid changes.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00756 | 0.00591 | 0.00372 | -1 |

| 2026 | 0.00963 | 0.00674 | 0.00654 | 12 |

| 2027 | 0.01171 | 0.00819 | 0.00467 | 36 |

| 2028 | 0.01104 | 0.00995 | 0.00716 | 65 |

| 2029 | 0.01469 | 0.01049 | 0.0086 | 74 |

| 2030 | 0.01561 | 0.01259 | 0.00781 | 109 |

BNB Attestation Service (BAS) Investment Strategy and Risk Management Report

IV. BAS Professional Investment Strategy and Risk Management

BAS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi participants, identity verification enthusiasts, and crypto holders seeking exposure to verification layer infrastructure

- Operational Recommendations:

- Accumulate BAS during market dips, particularly when prices fall below $0.006

- Hold through market cycles to capture long-term growth potential as adoption of on-chain identity verification increases

- Reinvest any rewards or gains to compound holdings over extended periods

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at $0.006, $0.00385 (all-time low), and $0.17051 (all-time high) to guide entry and exit decisions

- Volume Analysis: Monitor the 24-hour trading volume of approximately $213,947 to assess market liquidity and confirm price movements

-

Wave Trading Key Points:

- Trade within identified resistance zones when volume increases significantly

- Execute stop-loss orders 5-10% below entry points to manage downside risk

BAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total crypto portfolio

- Active Investors: 3-5% of total crypto portfolio

- Professional Investors: 5-8% of total crypto portfolio

(2) Risk Hedging Solutions

- Diversification Strategy: Balance BAS holdings with established layer-1 blockchain assets to reduce concentration risk

- Position Sizing: Never allocate more than 10% of total trading capital to any single emerging protocol token

(3) Security Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and easy access

- Cold Storage Approach: Transfer large holdings to secure offline storage for long-term preservation

- Security Precautions: Enable multi-factor authentication on all exchange accounts, use hardware security keys, and maintain private key backups in secure locations

V. BAS Potential Risks and Challenges

BAS Market Risk

- High Volatility: BAS has experienced significant price fluctuations, dropping from an all-time high of $0.17051 to a low of $0.00385, representing extreme volatility that can result in substantial losses

- Limited Trading Volume: With only 11 exchange listings and daily volume around $213,947, liquidity may be insufficient during rapid market movements, potentially causing slippage

- Early-Stage Adoption: As an emerging verification layer, BAS faces uncertainty regarding mainstream adoption rates and actual use cases across DeFi and RWA applications

BAS Regulatory Risk

- Regulatory Uncertainty: KYC and identity verification services operate in evolving regulatory landscapes that vary significantly by jurisdiction

- Compliance Burden: Increased regulatory scrutiny on identity verification platforms could impose additional compliance costs and operational constraints

- Geopolitical Factors: Restrictions on cross-border data sharing and identity information could impact the platform's global utility

BAS Technical Risk

- Smart Contract Vulnerabilities: As a relatively new protocol, potential undiscovered bugs or exploits in smart contracts could threaten fund security

- Integration Complexity: Composable verification across multiple chains and platforms introduces technical dependencies and integration risks

- Competition from Established Systems: Incumbent identity verification and KYC providers may develop blockchain-based alternatives with greater resources

VI. Conclusion and Action Recommendations

BAS Investment Value Assessment

BAS presents an interesting opportunity within the emerging verification and reputation infrastructure space on BNB Chain. As the native attestation service, it addresses a genuine need for composable on-chain KYC and identity verification as DeFi and real-world asset tokenization expand. However, investors should recognize that BAS remains in early stages with limited adoption metrics, significant price volatility, and unproven long-term market traction. The 42.63% year-over-year price increase indicates growing interest, yet the recent 0.05% 7-day decline and -1.29% 24-hour drop suggest market uncertainty. Success depends on ecosystem adoption across DeFi, RWA, and AI agent applications.

BAS Investment Recommendations

✅ Beginners: Start with a small, exploratory position (1-2% of crypto portfolio) through Gate.com to understand the project fundamentals before committing additional capital

✅ Experienced Investors: Consider dollar-cost averaging into BAS over several months, using technical support levels around $0.006 as accumulation zones, while maintaining strict position sizing rules

✅ Institutional Investors: Conduct comprehensive due diligence on the project team, audit history, and partnership roadmap before establishing positions; consider BAS as a small conviction trade rather than a core holding

BAS Trading Participation Methods

- Exchange Trading: Purchase BAS directly on Gate.com with fiat or cryptocurrency pairs

- Liquidity Provision: Participate in BAS/BNB or other trading pairs to earn yield through market-making activities

- Staking and Rewards: Explore governance opportunities and potential reward mechanisms as the BAS protocol matures

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult with professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will the Bakery token rise again?

Yes, Bakery Token is expected to continue its upward trend, likely trading between $0.013 to $0.015 by end of 2025, supported by positive market fundamentals and growing ecosystem adoption.

What factors influence BAS (Bakery token) price movements?

BAS price is influenced by market sentiment, trading volume on exchanges, supply and demand dynamics, and broader economic trends. Community activity and protocol developments also impact price movements.

What is the historical price performance of Bakery token and what are its current support/resistance levels?

BakeryToken (BAKE) historically shows volatility with 2025 trading range expected between $0.385-$0.4919. Current key resistance stands at $0.29, while strong support is positioned around $0.1988. Technical levels suggest bullish consolidation patterns.

How does Bakery protocol's development and adoption affect BAS token value?

Bakery protocol's development and adoption drive BAS token value growth through ecosystem expansion and increased DeFi utilization. Enhanced protocol features and wider adoption on Binance Smart Chain strengthen token demand and utility, supporting long-term value appreciation.

Latest analysis of BNB market capitalization in 2025: The position and prospects of Binance Coin in the Web3 ecosystem

How to Buy BNB in 2025: A Complete Guide for Newbie Investors

RWA on Avalanche (AVAX): How Real-World Assets Come On-Chain

What is THE: Understanding the Definite Article in English Grammar

Is Ondo Finance (ONDO) a good investment?: Analyzing the potential and risks of this innovative DeFi protocol

What is SAUCE: The Essential Guide to Understanding This Culinary Enhancement

Ultimate Guide to On-Chain Data Analysis Tools in Web3

Is NEM (XEM) a good investment?: A Comprehensive Analysis of NEM's Technology, Market Performance, and Future Potential in the Cryptocurrency Landscape

Discover the Features and Benefits of the Monad Testnet

Understanding Artificial Superintelligence: A Comprehensive Overview

OMG vs CRO: Which Cryptocurrency Offers Better Investment Potential in 2024?