2025 B2 Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: B2's Market Position and Investment Value

BSquared Network (B2) as a modular Bitcoin Scaling solution, has made significant strides in the cryptocurrency space since its inception. As of 2025, B2's market capitalization has reached $77,579,779.2, with a circulating supply of approximately 46,893,000 tokens, and a price hovering around $1.6544. This asset, often referred to as a "Bitcoin scaling innovator," is playing an increasingly crucial role in enhancing Bitcoin's scalability and efficiency.

This article will provide a comprehensive analysis of B2's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. B2 Price History Review and Current Market Status

B2 Historical Price Evolution

- 2025 June: B2 hit its all-time low of $0.3154

- 2025 October: B2 reached its all-time high of $2.2184, marking a significant price surge

- 2025 October 21: Price corrected to $1.6544, showing market volatility

B2 Current Market Situation

As of October 21, 2025, B2 is trading at $1.6544. The token has experienced a 24-hour decline of 8.36%, with the price ranging between a high of $1.9401 and a low of $1.5841. Despite the recent dip, B2 has shown remarkable growth over the past month, with a 146.84% increase in value. The current market capitalization stands at $77,579,779.2, ranking 476th in the crypto market. The circulating supply is 46,893,000 B2 tokens, representing 22.33% of the total supply of 210,000,000. The 24-hour trading volume is $932,862.57, indicating active market participation. The fully diluted market cap is $347,424,000, suggesting potential for future growth as more tokens enter circulation.

Click to view the current B2 market price

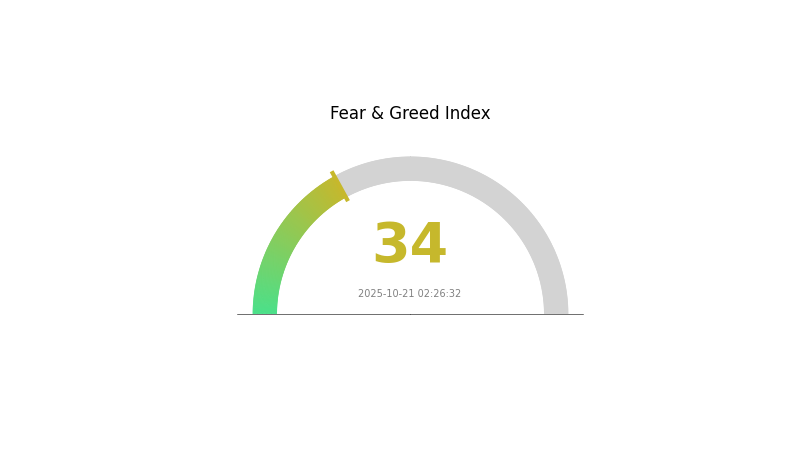

B2 Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index registering at 34. This suggests that investors are cautious and potentially hesitant to make bold moves. During such times, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and opportunities may arise for those who are well-prepared and patient. As always, diversification and risk management are key strategies to navigate uncertain market conditions.

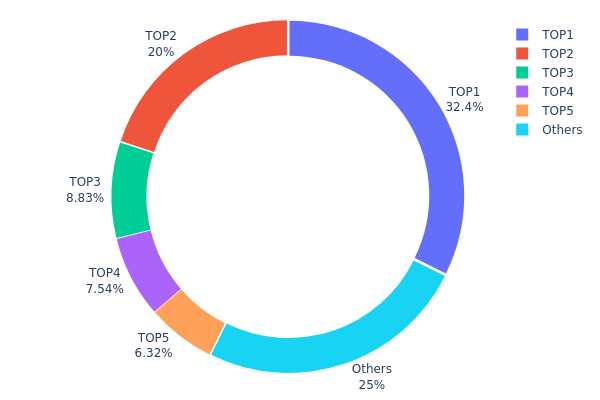

B2 Holdings Distribution

The address holdings distribution data reveals a significant concentration of B2 tokens among a few top addresses. The top holder possesses 32.35% of the total supply, while the top five addresses collectively control 75.04% of B2 tokens. This high concentration raises concerns about centralization and potential market manipulation risks.

Such a concentrated distribution could lead to increased price volatility and susceptibility to large-scale market movements initiated by these major holders. The disproportionate control held by a small number of addresses may also impact the token's governance and decision-making processes, potentially undermining its decentralization principles.

However, it's worth noting that 24.96% of the tokens are distributed among other addresses, which suggests some level of wider participation. This distribution pattern indicates a need for careful monitoring of major holders' activities and their potential impact on B2's market dynamics and long-term stability.

Click to view the current B2 holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa8fa...307120 | 67941.76K | 32.35% |

| 2 | 0xa8ca...6fc67c | 42000.00K | 20.00% |

| 3 | 0x1488...27c95f | 18543.00K | 8.83% |

| 4 | 0x69c2...2dc3ce | 15834.00K | 7.54% |

| 5 | 0xc882...84f071 | 13273.31K | 6.32% |

| - | Others | 52407.93K | 24.96% |

II. Key Factors Influencing Future B2 Prices

Supply Mechanism

- Central Bank Purchases: Central banks have been consistently increasing their gold holdings since 2022, with annual net purchases exceeding 1000 tons. This trend is expected to continue, with projected purchases of 900 tons in 2025.

- Historical Pattern: Central bank gold purchases have doubled compared to the average of the previous decade, accounting for 23% of total annual demand from 2022 to 2025.

- Current Impact: The sustained high level of central bank purchases is likely to provide ongoing support for gold prices.

Institutional and Large Investor Dynamics

- Institutional Holdings: Gold currently accounts for only 0.4% of U.S. bank private client wealth and 2.4% of institutional managed assets, suggesting potential for increased institutional investment.

- Corporate Adoption: ETFs have become a significant source of gold demand, with inflows reaching 397 tons in the first half of 2025, the highest level since 2020.

- National Policies: Geopolitical factors, including financial sanctions, have influenced central banks' decisions to increase gold holdings, particularly in economies affected by or at risk of Western sanctions.

Macroeconomic Environment

- Monetary Policy Impact: Expectations of Federal Reserve rate cuts and a weakening U.S. dollar index have contributed to gold's price surge.

- Inflation Hedging Properties: Gold has maintained its role as an effective portfolio diversification tool in the face of increased uncertainty and volatility.

- Geopolitical Factors: Tensions and potential government shutdowns in the U.S. have driven investors towards safe-haven assets like gold.

Technical Developments and Ecosystem Building

- ETF Market Growth: Gold ETFs have seen record inflows, with $17.6 billion entering gold funds over a four-week period, indicating strong investor interest.

- Retail Investment Trends: While demand for gold bars increased by 10% in 2024, coin purchases decreased by 31%. This trend is expected to continue in 2025.

- Ecosystem Applications: Physical gold net investment is projected to grow by 2% in 2025, reaching 1,218 tons, driven by optimistic price expectations in Asian markets.

III. B2 Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.89732 - $1.6617

- Neutral prediction: $1.6617 - $2.35961

- Optimistic prediction: $2.35961 (requires strong market momentum and positive B2 developments)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $1.16618 - $2.83503

- 2027: $1.45371 - $3.36775

- Key catalysts: Increasing adoption, technological advancements, and overall crypto market growth

2030 Long-term Outlook

- Base scenario: $3.72006 - $4.1334 (assuming steady market growth)

- Optimistic scenario: $4.1334 - $5.29075 (assuming strong B2 ecosystem expansion)

- Transformative scenario: Above $5.29075 (extreme favorable conditions and widespread B2 adoption)

- 2030-12-31: B2 $5.29075 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.35961 | 1.6617 | 0.89732 | 0 |

| 2026 | 2.83503 | 2.01066 | 1.16618 | 21 |

| 2027 | 3.36775 | 2.42284 | 1.45371 | 46 |

| 2028 | 4.14027 | 2.8953 | 2.25833 | 75 |

| 2029 | 4.74901 | 3.51778 | 2.77905 | 112 |

| 2030 | 5.29075 | 4.1334 | 3.72006 | 149 |

IV. Professional Investment Strategies and Risk Management for B2

B2 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high-risk tolerance and long-term perspective

- Operation suggestions:

- Accumulate B2 tokens during market dips

- Set price targets and regularly rebalance portfolio

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend direction and potential reversal points

- Relative Strength Index (RSI): Determine overbought or oversold conditions

- Key points for swing trading:

- Monitor Bitcoin's price movements as they may influence B2's performance

- Pay attention to project developments and partnerships announcements

B2 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for B2

B2 Market Risks

- High volatility: Significant price fluctuations common in the crypto market

- Liquidity risk: Potential difficulty in buying or selling large amounts

- Correlation with Bitcoin: B2's price may be influenced by Bitcoin's movements

B2 Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting B2

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws related to cryptocurrency transactions

B2 Technical Risks

- Smart contract vulnerabilities: Potential for coding errors or exploits

- Scalability challenges: Possible network congestion during high demand

- Interoperability issues: Compatibility problems with other blockchain networks

VI. Conclusion and Action Recommendations

B2 Investment Value Assessment

B2 Network presents a promising long-term value proposition as a Bitcoin scaling solution. However, short-term risks include high volatility and regulatory uncertainties.

B2 Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the technology ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider OTC trading for large positions

B2 Trading Participation Methods

- Spot trading: Buy and sell B2 tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities using B2 tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Bluzelle have a future?

Bluzelle's future appears uncertain. Current forecasts suggest minimal growth, with a bearish market outlook. Its potential may be influenced by prevailing market conditions.

What is the value of B2?

B2's value lies in its potential for growth in the Web3 ecosystem. As a cryptocurrency, it offers unique features and use cases that could drive its adoption and price appreciation in the coming years.

What is B2 crypto?

B2 Network is a Layer 2 scaling solution for Bitcoin, enhancing scalability and enabling smart contracts. It uses rollup technology to process transactions off-chain and settle them on the Bitcoin mainnet, improving speed and reducing costs.

How much will $1 Bitcoin be worth in 2025?

Based on current predictions, $1 Bitcoin could be worth between $100,000 and $150,000 in 2025, depending on market conditions.

2025 B2Price Prediction: Market Trends and Investment Opportunities for the Digital Currency

2025 MERL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Is BSquared Network (B2) a good investment?: Evaluating the potential and risks of this emerging blockchain platform

What is the Core Value and Risk Analysis of B2 Project in 2025?

2025 MERL Price Prediction: Will This Emerging Crypto Asset Reach New Heights?

Is Stacks (STX) a good investment?: Analyzing the potential of this Bitcoin layer-2 solution

Secure Wallet Solutions for Managing Tezos Blockchain Assets

Understanding the Process of NFT Creation: A Comprehensive Guide

Upcoming NFT Innovations for 2024

Top Bitcoin Yield Farming Solutions in DeFi

Top Anticipated NFT Ventures of 2024