2025 ATOM Price Prediction: Bullish Outlook as Cosmos Ecosystem Expands

Introduction: ATOM's Market Position and Investment Value

Cosmos (ATOM), as a pioneering blockchain interoperability platform, has achieved significant milestones since its inception in 2014. As of 2025, Cosmos's market capitalization has reached $1.58 billion, with a circulating supply of approximately 473 million tokens, and a price hovering around $3.34. This asset, often referred to as the "Internet of Blockchains," is playing an increasingly crucial role in facilitating cross-chain communication and interoperability.

This article will provide a comprehensive analysis of Cosmos's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ATOM Price History Review and Current Market Status

ATOM Historical Price Evolution

- 2019: ATOM launched at $0.1, price surged to $7.24 within months

- 2021: Bull market peak, ATOM reached all-time high of $44.45 on January 17, 2022

- 2022-2023: Crypto winter, price dropped from $44.45 to around $6

ATOM Current Market Situation

As of October 16, 2025, ATOM is trading at $3.345, with a market cap of $1,583,376,645. The token has experienced a 2.6% decrease in the past 24 hours and a significant 18.75% drop over the last week. The current price represents a 92.47% decline from its all-time high of $44.45. ATOM's market dominance stands at 0.039%, indicating a relatively small share of the overall crypto market. The token's fully diluted valuation is $1,307,660,967, with a circulating supply of 473,356,246 ATOM. Despite recent downward trends, ATOM maintains a position among the top 100 cryptocurrencies by market capitalization, ranking 71st.

Click to view current ATOM market price

ATOM Market Sentiment Indicator

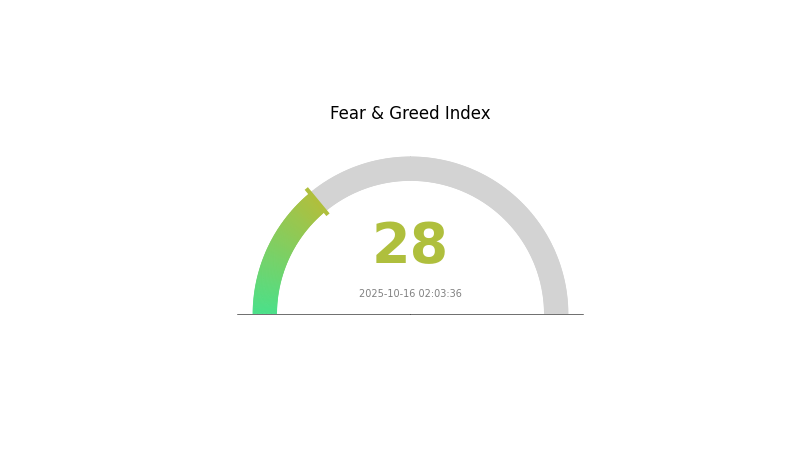

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index at 28. This suggests that investors are cautious and potentially pessimistic about ATOM's short-term prospects. During such times, it's crucial to conduct thorough research and consider long-term potential rather than making impulsive decisions. Remember, fear can sometimes present buying opportunities for those with a strong conviction in ATOM's fundamentals and future growth.

ATOM Holdings Distribution

The address holdings distribution data for ATOM reveals a relatively decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation by large individual holders appears to be minimal. This distribution pattern suggests a healthy level of decentralization within the ATOM ecosystem, potentially contributing to greater market stability and reduced volatility.

The absence of highly concentrated holdings also indicates a more equitable distribution of governance power within the Cosmos network. This aligns well with the principles of decentralized governance that many blockchain projects strive for. Furthermore, the current distribution pattern may foster a more robust and resilient network, as it reduces the potential impact of sudden large-scale sell-offs or acquisitions by individual entities.

Overall, the ATOM holdings distribution data reflects a mature and well-distributed token ecosystem. This characteristic could be viewed positively by investors and stakeholders, as it suggests a reduced risk of centralized control and a more democratic participation in the network's governance and value appreciation.

Click to view the current ATOM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing ATOM's Future Price

Supply Mechanism

- Staking: ATOM employs a staking mechanism that allows holders to earn rewards, potentially impacting the circulating supply.

- Current Impact: The staking mechanism may help stabilize prices by encouraging long-term holding.

Institutional and Whale Dynamics

- Institutional Holdings: While specific data is limited, institutional interest in ATOM could significantly influence its price.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, ATOM may be viewed as a potential hedge against inflation, similar to other digital assets.

Technological Development and Ecosystem Building

- Interoperability: Cosmos's focus on interoperability between blockchains could drive adoption and potentially impact ATOM's value.

- Ecosystem Applications: The growth of decentralized applications (DApps) within the Cosmos ecosystem may contribute to increased demand for ATOM.

III. ATOM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $2.62 - $3.36

- Neutral prediction: $3.36 - $4.00

- Optimistic prediction: $4.00 - $4.67 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth and consolidation

- Price range forecast:

- 2026: $2.65 - $4.14

- 2027: $3.79 - $5.79

- Key catalysts: Increased adoption of Cosmos ecosystem, technological upgrades

2028-2030 Long-term Outlook

- Base scenario: $4.93 - $6.32 (assuming steady ecosystem growth)

- Optimistic scenario: $6.32 - $7.46 (with accelerated adoption and partnerships)

- Transformative scenario: $7.46 - $9.03 (with major breakthroughs in interoperability)

- 2030-12-31: ATOM $6.32 (88% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.6704 | 3.36 | 2.6208 | 0 |

| 2026 | 4.13566 | 4.0152 | 2.65003 | 20 |

| 2027 | 5.78711 | 4.07543 | 3.79015 | 21 |

| 2028 | 5.42439 | 4.93127 | 3.8957 | 47 |

| 2029 | 7.45608 | 5.17783 | 4.60827 | 54 |

| 2030 | 9.03324 | 6.31695 | 3.97968 | 88 |

IV. Professional Investment Strategies and Risk Management for ATOM

ATOM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the Cosmos ecosystem

- Operation suggestions:

- Accumulate ATOM during market dips

- Stake ATOM to earn rewards and participate in governance

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Cosmos ecosystem developments and upgrades

- Pay attention to overall crypto market sentiment

ATOM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ATOM

ATOM Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the interoperability sector

- Market sentiment: Susceptible to overall crypto market trends

ATOM Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory changes

- Cross-border compliance: Challenges in meeting diverse global regulations

- Staking regulations: Possible restrictions on staking rewards

ATOM Technical Risks

- Network security: Potential vulnerabilities in the Cosmos network

- Scalability challenges: Maintaining performance as the ecosystem grows

- Interoperability issues: Risks associated with cross-chain communication

VI. Conclusion and Action Recommendations

ATOM Investment Value Assessment

ATOM presents long-term potential as a key player in blockchain interoperability, but faces short-term risks from market volatility and competition.

ATOM Investment Recommendations

✅ Beginners: Consider small, long-term positions and educate on the Cosmos ecosystem ✅ Experienced investors: Implement a balanced approach of holding and active trading ✅ Institutional investors: Evaluate ATOM as part of a diversified crypto portfolio

ATOM Trading Participation Methods

- Spot trading: Buy and sell ATOM on Gate.com

- Staking: Participate in network security and earn rewards

- Governance: Engage in Cosmos ecosystem decision-making through voting

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can cosmos reach $100?

Yes, Cosmos could potentially reach $100 by the end of 2025. Long-term forecasts suggest it may achieve even higher values. Current market predictions for ATOM are generally optimistic.

Is ATOM coin a good investment?

ATOM shows promise as a solid investment in the Web3 ecosystem. Its interoperability features and growing adoption suggest potential for significant value appreciation in the coming years.

How much will Cosmos cost in 2030?

Based on current market analysis, Cosmos (ATOM) is predicted to cost between $3.70 and $3.74 in 2030.

What is the ATOM price forecast for 2025?

Based on current projections, the ATOM price forecast for 2025 suggests a minimum value of $3.27 and an average value of $3.35 per token, which is below current market levels.

NKN vs ATOM: Comparing Two Blockchain Network Solutions for Decentralized Communication and Interoperability

DUCK vs ATOM: A Comparative Analysis of Modern Web Development Frameworks

DADDY vs ATOM: A Battle of Molecular Bonds in Modern Chemistry

NIL vs ATOM: Exploring the Fundamental Concepts in Lisp Programming

GALFAN vs ATOM: A Comparative Analysis of Advanced Corrosion Resistant Coatings for Steel Applications

BNC vs ATOM: Comparing Two Cutting-Edge Blockchain Networks for Enterprise Solutions

Is SpaceN (SN) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential

Is Tribe (TRIBE) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in 2024

Is JOE (JOE) a good investment? A Comprehensive Analysis of Market Performance, Fundamentals, and Risk Factors

Guide to Engaging in Parachain Auctions on Polkadot

Is Electroneum (ETN) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook for 2024