2025 ALT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ALT's Market Position and Investment Value

AltLayer (ALT), as an open and decentralized protocol for rollups, has been making waves in the blockchain ecosystem since its inception. As of 2025, AltLayer's market capitalization has reached $87,402,833, with a circulating supply of approximately 4,477,604,164 tokens, and a price hovering around $0.01952. This asset, dubbed the "Rollup Enhancer," is playing an increasingly crucial role in improving the security, decentralization, and interoperability of various rollup solutions.

This article will provide a comprehensive analysis of AltLayer's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. ALT Price History Review and Current Market Status

ALT Historical Price Evolution Trajectory

- 2024: ALT launched, price started at $0.018

- 2024: Reached all-time high of $0.6948 on March 27, 2024

- 2025: Market downturn, price dropped to all-time low of $0.00831 on October 10, 2025

ALT Current Market Situation

As of October 21, 2025, ALT is trading at $0.01952, with a 24-hour trading volume of $878,734.61. The current price represents a 2.78% increase in the last 24 hours, but a significant 83.78% decrease over the past year. ALT's market capitalization stands at $87,402,833.28, ranking it 438th in the crypto market. The token has a circulating supply of 4,477,604,164 ALT out of a total supply of 10,000,000,000 ALT. Despite recent gains, ALT remains 97.19% below its all-time high, indicating a challenging market environment.

Click to view the current ALT market price

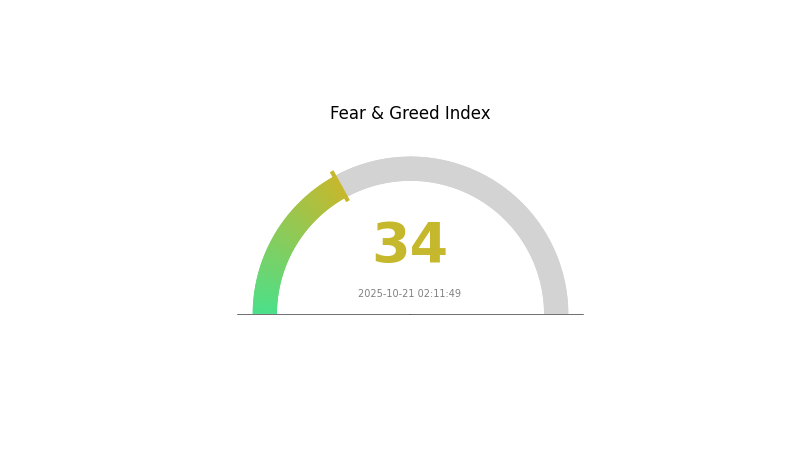

ALT Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains cautious as the Fear and Greed Index stands at 34, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can lead to further price declines, it often presents a chance for long-term investors to accumulate assets at lower prices. However, traders should remain vigilant and consider diversifying their portfolios to mitigate risks in this uncertain market environment.

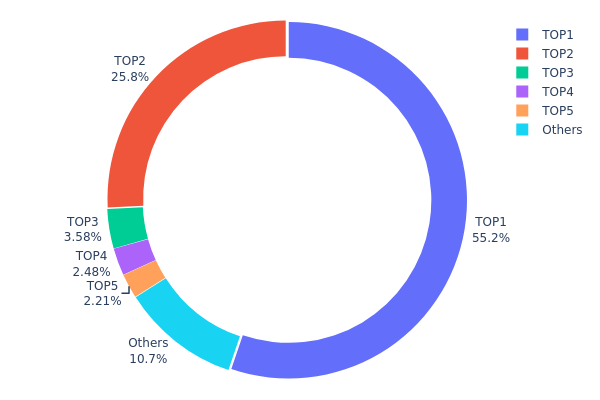

ALT Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for ALT. The top address holds a commanding 55.22% of the total supply, while the second largest holder accounts for an additional 25.78%. This means that just two addresses control over 80% of ALT tokens, indicating an extreme level of centralization.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With so much power concentrated in few hands, large movements from these top holders could significantly impact ALT's price and liquidity. This centralization also contradicts the principles of decentralization often associated with cryptocurrencies.

The current distribution suggests a relatively immature market structure for ALT, with limited circulation among a broader base of holders. This concentration may deter some investors due to perceived risks of whale dominance and potential market instability. However, it's worth monitoring if this distribution evolves over time as the project develops and potentially attracts a more diverse holder base.

Click to view the current ALT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x12a6...97b1c0 | 5522395.84K | 55.22% |

| 2 | 0xabf2...f840b0 | 2578048.51K | 25.78% |

| 3 | 0xf977...41acec | 357607.26K | 3.57% |

| 4 | 0xb6d1...35890b | 247914.19K | 2.47% |

| 5 | 0xf721...72def7 | 221491.32K | 2.21% |

| - | Others | 1072542.89K | 10.75% |

II. Key Factors Influencing ALT's Future Price

Supply Mechanism

- Token Distribution: 18.5% allocated to investors, 5% to Gate.com Launchpool, 15% to team, 5% to strategic advisors, 20% to protocol development, 21.5% to treasury, and 15% to ecosystem and community.

- Current Impact: The balanced token distribution supports long-term project development and ecosystem growth, potentially influencing price stability and growth.

Institutional and Whale Dynamics

- Enterprise Adoption: AltLayer's Restaked Rollup technology gaining adoption in the blockchain ecosystem could significantly impact ALT's price.

Macroeconomic Environment

- Inflation Hedging Properties: As a blockchain project, ALT may be viewed as a potential hedge against inflation, similar to other digital assets.

Technological Development and Ecosystem Building

- Restaked Rollup Technology: AltLayer's core technology aims to provide highly scalable solutions for blockchain applications, which could drive demand and price appreciation.

- Ecosystem Applications: The development of VITAL, MACH, and SQUAD products within the AltLayer ecosystem may contribute to increased utility and value for ALT tokens.

III. ALT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01169 - $0.01949

- Neutral prediction: $0.01949 - $0.02193

- Optimistic prediction: $0.02193 - $0.02436 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01861 - $0.03101

- 2028: $0.01769 - $0.03769

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.03455 - $0.04018 (assuming steady market growth)

- Optimistic scenario: $0.04018 - $0.05464 (assuming strong market performance)

- Transformative scenario: $0.05464+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: ALT $0.05464 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02436 | 0.01949 | 0.01169 | 0 |

| 2026 | 0.03201 | 0.02193 | 0.01338 | 12 |

| 2027 | 0.03101 | 0.02697 | 0.01861 | 38 |

| 2028 | 0.03769 | 0.02899 | 0.01769 | 48 |

| 2029 | 0.04701 | 0.03334 | 0.01867 | 70 |

| 2030 | 0.05464 | 0.04018 | 0.03455 | 105 |

IV. ALT Professional Investment Strategies and Risk Management

ALT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate ALT during market dips

- Set price targets for partial profit-taking

- Store ALT in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor ALT's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage downside risk

ALT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for ALT

ALT Market Risks

- High volatility: ALT price can experience significant swings

- Limited liquidity: May face challenges in large-volume trades

- Market sentiment: Susceptible to broader crypto market trends

ALT Regulatory Risks

- Uncertain regulatory landscape: Potential for unfavorable regulations

- Cross-border compliance: Varying regulations across jurisdictions

- Taxation complexities: Evolving tax treatment of crypto assets

ALT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues as network usage grows

- Competitive landscape: Emerging technologies could outpace ALT

VI. Conclusion and Action Recommendations

ALT Investment Value Assessment

ALT presents a high-risk, high-reward opportunity in the evolving rollup ecosystem. While it offers innovative solutions for rollup security and interoperability, investors should be aware of its significant volatility and regulatory uncertainties.

ALT Investment Recommendations

✅ Beginners: Allocate only a small portion of portfolio, focus on education ✅ Experienced investors: Consider dollar-cost averaging, set clear profit targets ✅ Institutional investors: Conduct thorough due diligence, implement robust risk management

ALT Trading Participation Methods

- Spot trading: Purchase ALT directly on Gate.com

- Staking: Participate in ALT staking programs if available

- DeFi: Explore ALT-based liquidity provision on compatible platforms

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price target for ALT in 2025?

Based on analyst forecasts, ALT's price target for 2025 is estimated to be around $15-20 per share, considering projected EPS improvements and potential market growth.

Is ALT a good stock to buy?

ALT shows potential for growth in the web3 and crypto market. Its innovative technology and increasing adoption make it an attractive investment option for 2025.

What is the price prediction for ALT crypto in 2030?

Based on current market analysis, the price prediction for ALT crypto in 2030 is estimated to be between $0.02260 and $0.03894.

Which altcoins will skyrocket?

Ethereum and Solana are poised for explosive growth in 2026. Their advanced tech and growing ecosystems make them prime candidates to outperform the market.

2025 KAIA Price Prediction: Expected Market Trends and Investment Outlook for the Innovative Digital Asset

Understanding Directed Acyclic Graphs in Blockchain Technology

Understanding Directed Acyclic Graph in Blockchain Technology

Exploring DAG Technology in Blockchain Networks

Exploring Directed Acyclic Graph in Blockchain Networks

Exploring Directed Acyclic Graphs in Blockchain Technology

How does Ondo Finance navigate regulatory compliance and SEC approval in the crypto industry?

What is RPC in Crypto Assets and its importance to traders and investors

What is KSM: A Comprehensive Guide to Kusama Network and Its Role in the Polkadot Ecosystem

What is ICP Competitive Analysis: Complete Guide to Market Share, Performance, and Differentiation Strategy?

Kryptex Explanation: Is crypto mining still profitable for beginners?