ETHEN

No content yet

ETHEN

LUNC is unwinding sharply after failing to hold the breakout area near 0.00008160. The 15m structure has flipped from steady uptrend to clear corrective flow. Price has sliced through the MA5, MA10 and MA30 with momentum, and all three moving averages are now turning down. This signals a strong shift in short term control toward sellers.

The rejection at the top was clean and aggressive. Liquidity stacked near 0.00008100 absorbed the final wave of buying and triggered a rotation lower.

The follow through candles show increasing sell volume, which confirms that the move is not just profit taki

The rejection at the top was clean and aggressive. Liquidity stacked near 0.00008100 absorbed the final wave of buying and triggered a rotation lower.

The follow through candles show increasing sell volume, which confirms that the move is not just profit taki

LUNC-3.73%

- Reward

- 1

- Comment

- Repost

- Share

When I look at the bond market right now, there’s a clear message forming and it’s louder than anything the Fed is saying publicly.

There’s stress, there’s rising yields, and there’s a point where policy mistakes can’t be hidden behind speeches anymore.

And every time we’ve seen this setup in the past, the outcome wasn’t debate it was QE. Liquidity returns, yields drop, the dollar softens and risk assets ignite.

If the Fed really steps back in, this market won’t wait. I’ve lived through 2020–21 when liquidity flips, everything changes fast.

This is exactly the kind of environment where the

There’s stress, there’s rising yields, and there’s a point where policy mistakes can’t be hidden behind speeches anymore.

And every time we’ve seen this setup in the past, the outcome wasn’t debate it was QE. Liquidity returns, yields drop, the dollar softens and risk assets ignite.

If the Fed really steps back in, this market won’t wait. I’ve lived through 2020–21 when liquidity flips, everything changes fast.

This is exactly the kind of environment where the

- Reward

- 1

- Comment

- Repost

- Share

When I look at Tom Lee’s call, there’s a reason I don’t brush it off. I’ve seen moments where ETH looked “done” and then flipped the entire market. If momentum, ETF flow and supply shock line up, there’s a real path to levels people aren’t ready for. $ETH still has a bigger chapter ahead.

$ETH #JoinGrowthPointsDrawToWiniPhone17

#DecemberMarketOutlook

#PostonSquaretoEarn$50

#LINKETFToLaunch

#SharingMy100xToken

$ETH #JoinGrowthPointsDrawToWiniPhone17

#DecemberMarketOutlook

#PostonSquaretoEarn$50

#LINKETFToLaunch

#SharingMy100xToken

ETH0.19%

- Reward

- 1

- Comment

- Repost

- Share

When I look at this case, I’m reminded how fast sentiment shifts in crypto. One moment there’s hype, and the next there’s a $40B collapse that leaves scars across the whole market.

There was always going to be a point where accountability caught up, and it feels like we’re finally there. Justice moving doesn’t erase the damage, but it does show the space is maturing slowly, painfully, but moving.

#JoinGrowthPointsDrawToWiniPhone17

#DecemberMarketOutlook

#PostonSquaretoEarn$50

$BTC

$GT

There was always going to be a point where accountability caught up, and it feels like we’re finally there. Justice moving doesn’t erase the damage, but it does show the space is maturing slowly, painfully, but moving.

#JoinGrowthPointsDrawToWiniPhone17

#DecemberMarketOutlook

#PostonSquaretoEarn$50

$BTC

$GT

- Reward

- 1

- Comment

- Repost

- Share

SOL is trading around 132.73 after rejecting the 133.99 level, and the 15m chart shows a clean shift into short term consolidation. The break attempt above 134 ran into a thick liquidity block, where sellers quickly absorbed momentum and forced price back toward the moving average cluster around 133.

Price is now sitting below the MA10 and MA30, with all three short term averages starting to flatten. That signals a pause in trend strength rather than a full reversal. Volume has been tapering on the move down, which suggests the pullback is driven by normal rotation rather than liquidation flow

Price is now sitting below the MA10 and MA30, with all three short term averages starting to flatten. That signals a pause in trend strength rather than a full reversal. Volume has been tapering on the move down, which suggests the pullback is driven by normal rotation rather than liquidation flow

SOL-0.29%

- Reward

- 1

- Comment

- Repost

- Share

XRP is sitting around 2.034 after a clean bounce off 2.015, and the 15m chart shows a market stuck in a tight range with neither side showing real dominance. The rejection at 2.051 came right at a liquidity pocket where sellers were waiting. Buyers pushed into that zone but could not sustain momentum, which led to a rotation back toward the mid range.

Price is now trading inside a compression zone where the MA5, MA10, and MA30 are overlapping. This usually signals indecision rather than trend. Volume has been fading during the recent candles, which shows traders are waiting for a clearer direc

Price is now trading inside a compression zone where the MA5, MA10, and MA30 are overlapping. This usually signals indecision rather than trend. Volume has been fading during the recent candles, which shows traders are waiting for a clearer direc

XRP0.24%

- Reward

- 2

- 1

- Repost

- Share

EagleEye :

:

It’s just the best 👌GT is sliding back toward 10.14 after failing to hold the breakout attempt into 10.27. The 15m structure shows a clear loss of short term momentum. Price slipped below the MA5, MA10, and MA30 cluster, and all three averages are now flattening, which signals that buyers have stepped back and intraday control has shifted toward sellers.

The rejection at 10.27 came from a concentrated liquidity pocket. As soon as price tapped that zone, sell orders absorbed the remaining momentum and forced a reversal. The move down has been clean and steady, with no liquidation style wicks or forced exits. Fundi

The rejection at 10.27 came from a concentrated liquidity pocket. As soon as price tapped that zone, sell orders absorbed the remaining momentum and forced a reversal. The move down has been clean and steady, with no liquidation style wicks or forced exits. Fundi

GT0.58%

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin is trading around 89,700 after a quick push into 90,284 earlier, and the 15m structure shows a market still searching for direction inside a tight intraday range.

The rejection from the 90,200 zone came from a clear block of resting liquidity, where sellers absorbed momentum and forced price back toward the cluster of short term moving averages around 89,750.

The move down from the high was not liquidation driven. There were no long wicks or forced exits on the tape, and funding across major perp markets remains neutral. This confirms that the pullback is coming from tactical profit t

The rejection from the 90,200 zone came from a clear block of resting liquidity, where sellers absorbed momentum and forced price back toward the cluster of short term moving averages around 89,750.

The move down from the high was not liquidation driven. There were no long wicks or forced exits on the tape, and funding across major perp markets remains neutral. This confirms that the pullback is coming from tactical profit t

BTC-0.13%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin is rotating higher again after defending the 92,700 region earlier in the session. That level has acted as a clean liquidity shelf, where both spot buyers and short covering stepped in. The 15m chart shows BTC reclaiming its short term moving averages, with the MA5 and MA10 curling upward and tightening. This usually signals that momentum is shifting back toward buyers after a corrective phase.

The rejection at 94,189 earlier came from a heavy block of resting liquidity. Once price tapped that area, sellers pressed back and forced a retrace, but there was no aggressive liquidation casc

The rejection at 94,189 earlier came from a heavy block of resting liquidity. Once price tapped that area, sellers pressed back and forced a retrace, but there was no aggressive liquidation casc

BTC-0.13%

- Reward

- 1

- Comment

- Repost

- Share

When I saw that Trump holds over $500M in ETH, my first thought was narratives shift fast, but capital speaks louder than headlines. This isn’t random exposure; it’s conviction from someone who moves with timing. When there’s that kind of weight behind Ethereum, I don’t rush exits I study the pattern behind the power move.

#JoinGrowthPointsDrawToWiniPhone17

#DecemberRateCutForecast

#ReboundTokenstoWatch

#CryptoMarketRebounds

$ETH

#JoinGrowthPointsDrawToWiniPhone17

#DecemberRateCutForecast

#ReboundTokenstoWatch

#CryptoMarketRebounds

$ETH

ETH0.19%

- Reward

- 1

- Comment

- Repost

- Share

When I saw the headline, my first thought was simple smart money moves early. If Trump’s betting big on bonds, he’s not chasing yield, he’s front running rate cuts. I’ve seen this setup before when liquidity shifts, the real pump starts quietly. The bond market always whispers before the Fed speaks.

#TopGainersInADownMarket

#FOMCMeetingMinutesComingUp

#BitcoinPriceWatch

$GT $BTC

#TopGainersInADownMarket

#FOMCMeetingMinutesComingUp

#BitcoinPriceWatch

$GT $BTC

- Reward

- 1

- Comment

- Repost

- Share

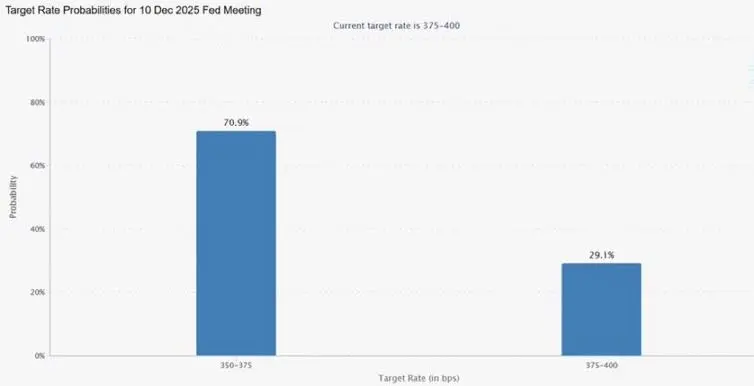

When I saw that 70% probability jump for a December rate cut, it clicked liquidity is about to make its move. Rate cuts don’t just change borrowing costs; they shift the entire risk curve. Every cycle, when this probability crosses 70%, risk assets start breathing again. We might be closer to the next rotation than most realize.

#TopGainersInADownMarket

#FOMCMeetingMinutesComingUp

#BitcoinPriceWatch

#MySuggestionsforGateSquare

#TopGainersInADownMarket

#FOMCMeetingMinutesComingUp

#BitcoinPriceWatch

#MySuggestionsforGateSquare

- Reward

- 1

- Comment

- Repost

- Share

BTC Just Flushed Hard and This Is Where Smart Money Reacts

BTC just swept down to 84.4K after tapping 81.2K liquidity, and this move is exactly the kind of shakeout that clears late longs and resets momentum. I’m watching this structure closely because the reaction candle is finally showing buyers stepping in on increasing volume.

Right now price is sitting under the short MAs, so the pressure is still bearish, however the liquidity sweep below 82K usually leads to a relief push. Therefore I’m positioning for two scenarios.

If BTC holds above 84K, I expect a recovery toward 85.6K first and 86

BTC just swept down to 84.4K after tapping 81.2K liquidity, and this move is exactly the kind of shakeout that clears late longs and resets momentum. I’m watching this structure closely because the reaction candle is finally showing buyers stepping in on increasing volume.

Right now price is sitting under the short MAs, so the pressure is still bearish, however the liquidity sweep below 82K usually leads to a relief push. Therefore I’m positioning for two scenarios.

If BTC holds above 84K, I expect a recovery toward 85.6K first and 86

BTC-0.13%

- Reward

- 3

- Comment

- Repost

- Share

ETH just printed a strong recovery candle on the 15m right from the liquidity sweep near 3030 and buyers stepped in fast. Price is now holding above the short-term moving averages again, which tells me momentum is shifting back to the upside.

If ETH keeps closing above 3075, I expect a push toward 3110 first and then 3140. Losing 3045 on a close would weaken the setup, so that is the level to watch.

My signal for now is simple: I stay bullish as long as ETH keeps building higher lows on the 15m. Momentum is returning, buyers are active again and the chart wants continuation.

Clear levels

Entr

If ETH keeps closing above 3075, I expect a push toward 3110 first and then 3140. Losing 3045 on a close would weaken the setup, so that is the level to watch.

My signal for now is simple: I stay bullish as long as ETH keeps building higher lows on the 15m. Momentum is returning, buyers are active again and the chart wants continuation.

Clear levels

Entr

ETH0.19%

- Reward

- 2

- 1

- Repost

- Share

HardworkingPig :

:

2980When I saw this chart, it reminded me how quietly cycles repeat. There’s always that moment no euphoria, no mania just exhaustion before policy flips. 2019 proved that tops can form in silence, not hype. When QT ends, liquidity shifts fast, and that’s where the next real move usually begins.

#TopGainersInADownMarket #FOMCMeetingMinutesComingUp #BitcoinPriceWatch

#TopGainersInADownMarket #FOMCMeetingMinutesComingUp #BitcoinPriceWatch

- Reward

- 2

- 1

- Repost

- Share

SYEDA :

:

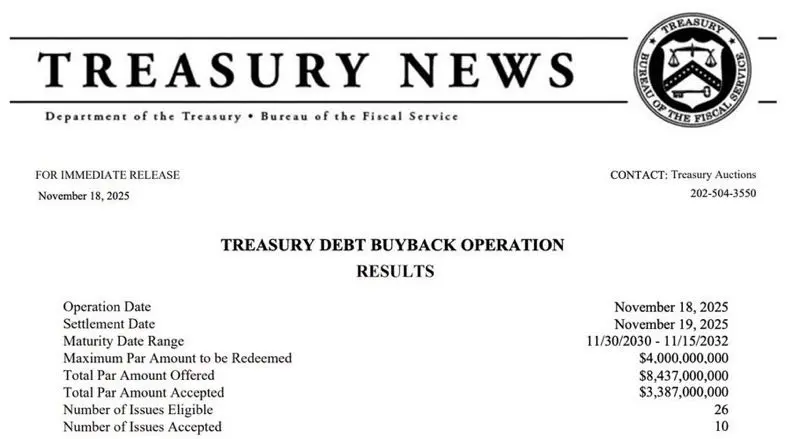

🔥When I saw this, I knew it wasn’t just another headline. When the U.S. Treasury starts buying back $3.4B of its own debt, that’s not cleanup it’s quiet liquidity injection. Every buyback shifts the balance sheet narrative a little closer to stealth QE. Markets may not react instantly, but liquidity always finds its way into prices.

#TopGainersInADownMarket

#FOMCMeetingMinutesComingUp

#BitcoinPriceWatch

#TopGainersInADownMarket

#FOMCMeetingMinutesComingUp

#BitcoinPriceWatch

- Reward

- 2

- Comment

- Repost

- Share