How Will Rate Cuts Affect BTC?

The Fed is expected to deliver its first rate cut of the cycle in September. Historically, Bitcoin has rallied into easing, only to fade once the cut arrives. But the pattern has not always held.

This piece looks at 2019, 2020, and 2024 to frame what September 2025 might bring. For the full take please head over to @Delphi_Digital members portal (link at bottom)

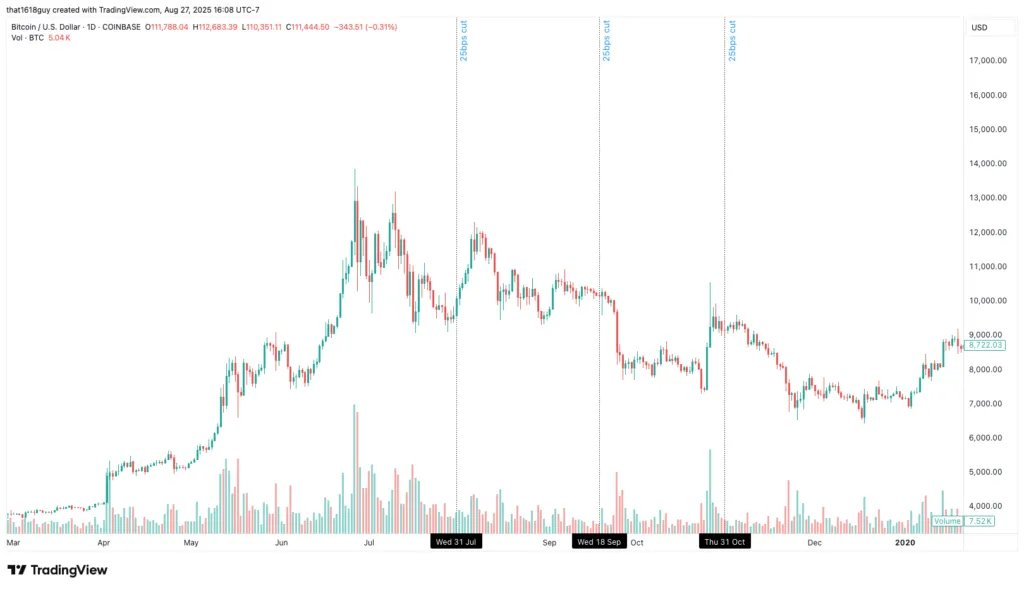

2019: Pump Into, Dump Out

In 2019, $BTC rallied from $3k in late 2018 to $13k by June. The Fed cut rates on July 31, September 18, and October 30.

Each decision marked exhaustion. $BTC pumped into the meeting, then sold off after as weaker growth reasserted itself. Rate cuts were priced ahead of time and the reality of slowing growth dominated.

2020: Emergency Cuts

March 2020 was not a cycle. The Fed slashed rates to zero amid Covid panic. $BTC dumped with equities in the liquidity crisis, then ripped back as fiscal and monetary support cascaded.

This was a crisis play, not a template for 2025.

2024: Narrative Overpowers Liquidity

2024 and a change in trend. Instead of fading after cuts, $BTC extended higher.

Why?

Trump’s campaign turned crypto into an election issue.

Spot ETFs were absorbing record inflows.

MicroStrategy’s balance sheet bid was still strong.

Liquidity mattered less. Structural buyers and political tailwinds overrode the cycle.

September 2025: Conditional Setup

The current backdrop does not mirror the runaway rallies of past cycles. Bitcoin has been consolidating through late August, ETF inflows have slowed considerably and the corporate balance sheet bid that once acted as a consistent tailwind has started to fade.

That leaves September’s rate cut as a conditional setup rather than a straightforward catalyst. If Bitcoin rallies sharply into the meeting, the risk is that history repeats - a “pump into, dump out” dynamic as traders sell the fact once easing arrives.

But if price action remains flat or drifts lower into the decision, much of the excess positioning may already be flushed, allowing the cut to act more as a stabilizer than an exhaustion point.

Bottom Line

September’s cut is less about the Fed itself and more about the liquidity backdrop that follows.

My view is that Bitcoin rallies into the September FOMC, but could stall short of a new high. Depending on the price action leading into the cut, if we rally hard into it, a sell the news is likely. But if we consolidate and drop into 1st-2nd week of September into FOMC, the cut might surprise the king corn to the upside. However, the next rally should be treated with caution as there will be a lower high watch (anything from 118-120k)

Assuming we get a lower high, that pause should set the stage for renewed momentum in the back half of Q4 to new all-time highs as liquidity conditions stabilize and demand rebuilds.

Disclaimer:

- This article is reprinted from [that1618guy]. All copyrights belong to the original author [that1618guy]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

Notcoin & UXLINK: On-chain Data Comparison