Predicción del precio de TOK en 2025: Perspectiva optimista gracias al impulso en la adopción y a la mejora del sentimiento de mercado

Introducción: Posición de mercado de TOK y valor de inversión

TOKAI (TOK), como plataforma de vídeos cortos con IA desarrollada sobre el ecosistema Solana, ha consolidado su presencia en el mercado cripto desde su inicio. En 2025, la capitalización bursátil de TOKAI es de 221 754 $, con una oferta en circulación de unos 780 000 000 tokens y un precio en torno a 0,0002843 $. Este activo, reconocido por su “precio de IA orientado al mercado”, está adquiriendo un papel cada vez más relevante en los ámbitos de la inteligencia artificial y el contenido de vídeo breve.

En este artículo se presenta un análisis completo de la evolución del precio de TOKAI entre 2025 y 2030, considerando patrones históricos, oferta y demanda, desarrollo del ecosistema y factores macroeconómicos, con el objetivo de ofrecer previsiones profesionales de precio y estrategias de inversión prácticas para los inversores.

I. Revisión histórica del precio de TOK y estado actual del mercado

Evolución histórica del precio de TOK

- 2024: Lanzamiento inicial, el precio alcanzó su máximo histórico de 0,0135 $ el 23 de agosto

- 2024: Corrección del mercado, el precio descendió a su mínimo histórico de 0,0000647 $ el 12 de noviembre

- 2025: Fase de recuperación, precio fluctuando entre 0,0002 $ y 0,0003 $

Situación actual del mercado de TOK

A 1 de noviembre de 2025, TOK cotiza a 0,0002843 $, con un volumen negociado en 24 h de 9 866,91 $. El token registra un descenso del 1,52 % en las últimas 24 h. TOK tiene una capitalización bursátil de 221 754 $, lo que lo sitúa en el puesto 4 233 del mercado cripto.

El precio actual supone una caída notable respecto a su máximo histórico de 0,0135 $. Sin embargo, ha mostrado resiliencia al mantenerse muy por encima de su mínimo de 0,0000647 $. El rendimiento del token ha sido dispar según el periodo: sube un 4,46 % en la última semana y cae un 25,45 % en los últimos 30 días.

La oferta en circulación de TOK es de 780 000 000 tokens, equivalente al 78 % de su máximo de 1 000 000 000. La capitalización de mercado totalmente diluida asciende a 284 300 $, lo que refleja potencial de crecimiento si el proyecto aumenta su adopción.

Haz clic para consultar el precio de mercado actual de TOK

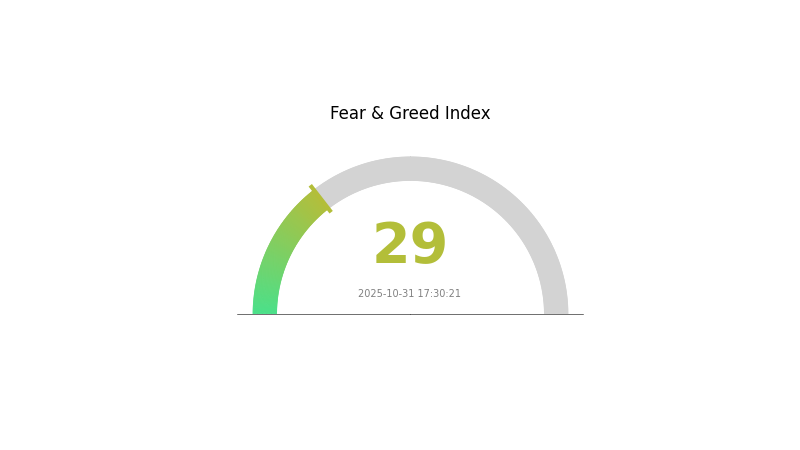

Indicador de sentimiento de mercado de TOK

31 de octubre de 2025, Índice de Miedo y Codicia: 29 (Miedo)

Haz clic para consultar el Índice de Miedo y Codicia actual

El mercado de criptomonedas atraviesa actualmente una fase de miedo, como refleja la lectura de 29 en el Índice de Miedo y Codicia. Esto indica que los inversores están cada vez más cautos y reacios al riesgo. Este tipo de sentimiento suele ofrecer oportunidades de compra a largo plazo, ya que los activos pueden estar infravalorados. No obstante, es fundamental investigar a fondo y actuar con prudencia antes de invertir. Mantente al tanto y valora diversificar tu cartera para mitigar riesgos en este contexto incierto.

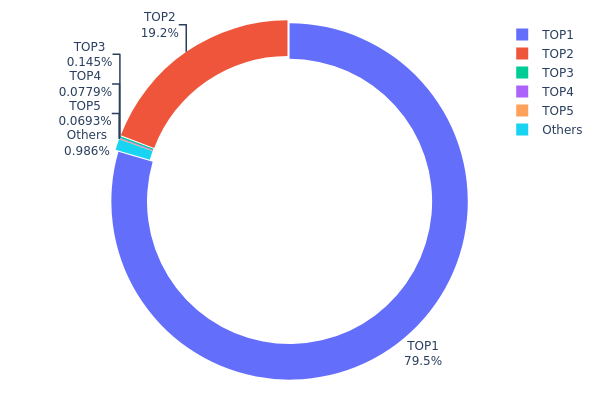

Distribución de tenencias de TOK

La distribución de direcciones muestra una estructura de propiedad muy concentrada en TOK. La principal dirección posee el 79,49 % del suministro total y la segunda mayor el 19,23 %. Así, solo dos direcciones controlan el 98,72 % de los TOK, lo que supone una centralización extrema.

Esta concentración plantea dudas sobre la estabilidad del mercado y el riesgo de manipulación de precios. Si los grandes titulares deciden vender o mover sus activos, pueden provocar oscilaciones bruscas. Además, implica que el ecosistema de TOK no estaría realmente descentralizado, ya que el poder de decisión recaería sobre unos pocos actores clave.

La estructura actual hace que la estabilidad on-chain de TOK y la dinámica general del mercado dependan de muy pocas direcciones. Esta concentración puede ahuyentar a inversores preocupados por la equidad y las prácticas de libre mercado, y afectar la sostenibilidad y adopción a largo plazo del token.

Haz clic para consultar la distribución de tenencias de TOK actual

| Top | Dirección | Cantidad | Porcentaje |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 619 988,29 K | 79,49 % |

| 2 | 8KEH9g...N5UtCa | 149 995,83 K | 19,23 % |

| 3 | 4jgYUd...nird2a | 1 129,55 K | 0,14 % |

| 4 | 8bVKpM...g1feAn | 607,63 K | 0,07 % |

| 5 | 4Ngyef...oDAFcu | 540,35 K | 0,06 % |

| - | Otros | 7 688,05 K | 1,01 % |

II. Factores determinantes del precio futuro de TOK

Mecanismo de suministro

- Halving: La reducción periódica de la emisión de TOK podría tener un impacto en el precio

- Patrones históricos: Los halvings previos suelen preceder subidas de precio

- Impacto actual: Se espera que el próximo halving reduzca la inflación y pueda respaldar el crecimiento del precio

Dinámica institucional y de grandes tenedores

- Tenencias institucionales: Las entidades institucionales están incorporando TOK progresivamente a sus carteras

- Adopción empresarial: Varias compañías relevantes ya aceptan TOK como pago o lo han añadido a su balance

- Políticas gubernamentales: La regulación en grandes economías puede influir decisivamente en la adopción y precio de TOK

Entorno macroeconómico

- Impacto de la política monetaria: Las decisiones de bancos centrales, especialmente la Reserva Federal, pueden afectar a TOK como activo alternativo

- Cobertura frente a la inflación: TOK ha atraído a inversores interesados en preservar el poder adquisitivo en escenarios inflacionistas

- Factores geopolíticos: Incertidumbres económicas mundiales y tensiones geopolíticas suelen aumentar el interés en TOK como valor refugio

Desarrollo tecnológico y crecimiento del ecosistema

- Lightning Network: La evolución y adopción de esta solución de capa 2 podría aumentar la utilidad de TOK como medio de pago

- Actualización Taproot: Mejoras en privacidad y contratos inteligentes pueden ampliar los usos de TOK

- Aplicaciones en el ecosistema: El número creciente de DApps y plataformas integradas con TOK amplía su utilidad y base de usuarios

III. Previsión del precio de TOK para 2025-2030

Perspectivas para 2025

- Escenario conservador: 0,00016 $ - 0,00025 $

- Escenario neutral: 0,00025 $ - 0,00028 $

- Escenario optimista: 0,00028 $ - 0,00031 $ (requiere una recuperación fuerte y mayor adopción)

Perspectivas para 2026-2028

- Fase de mercado prevista: crecimiento potencial con volatilidad elevada

- Previsión de rangos de precios:

- 2026: 0,00028 $ - 0,00038 $

- 2027: 0,00017 $ - 0,00049 $

- 2028: 0,00027 $ - 0,00044 $

- Factores clave: avances tecnológicos, mayor adopción y alianzas estratégicas

Perspectivas a largo plazo 2029-2030

- Escenario base: 0,00035 $ - 0,00047 $ (con crecimiento de mercado sostenido y desarrollo continuado del proyecto)

- Escenario optimista: 0,00047 $ - 0,00066 $ (con condiciones de mercado muy favorables e hitos relevantes)

- Escenario transformador: más de 0,00066 $ (si se producen innovaciones disruptivas y adopción masiva)

- 31 de diciembre de 2030: TOK 0,00066 $ (máximo potencial en un escenario muy favorable)

| Año | Precio máximo previsto | Precio medio previsto | Precio mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,00031 | 0,00028 | 0,00016 | 0 |

| 2026 | 0,00038 | 0,0003 | 0,00028 | 4 |

| 2027 | 0,00049 | 0,00034 | 0,00017 | 18 |

| 2028 | 0,00044 | 0,00042 | 0,00027 | 46 |

| 2029 | 0,00047 | 0,00043 | 0,00035 | 50 |

| 2030 | 0,00066 | 0,00045 | 0,00033 | 58 |

IV. Estrategias de inversión profesionales y gestión del riesgo para TOK

Metodología de inversión en TOK

(1) Estrategia de tenencia a largo plazo

- Perfil adecuado: inversores a largo plazo con elevada tolerancia al riesgo

- Consejos operativos:

- Acumula TOK en retrocesos de mercado

- Define objetivos de precio y reequilibra la cartera de forma periódica

- Conserva los tokens en wallets seguras y con copia de seguridad

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: para identificar tendencias y posibles giros

- Índice de fuerza relativa (RSI): monitoriza condiciones de sobrecompra o sobreventa

- Puntos clave para swing trading:

- Sigue la actualidad del sector IA y las novedades del ecosistema Solana

- Utiliza stop-loss para controlar el riesgo a la baja

Marco de gestión del riesgo en TOK

(1) Principios de asignación de activos

- Perfil conservador: 1-3 % de la cartera cripto

- Perfil agresivo: 5-10 % de la cartera cripto

- Profesional: hasta un 15 % de la cartera cripto

(2) Soluciones de cobertura de riesgos

- Diversificación: reparte la inversión entre varios proyectos blockchain e IA

- Stop-loss: utilízalos para limitar posibles pérdidas

(3) Soluciones de almacenamiento seguro

- Recomendación de hot wallet: Gate Web3 Wallet

- Almacenamiento en frío: hardware wallet para guardar a largo plazo

- Precauciones: activa la autenticación en dos pasos y utiliza contraseñas robustas

V. Riesgos y retos potenciales de TOK

Riesgos de mercado de TOK

- Alta volatilidad: las fluctuaciones de precio pueden ser muy acusadas a corto plazo

- Liquidez limitada: actualmente cotiza en pocos exchanges, lo que puede afectar a la ejecución

- Competencia: otros proyectos blockchain centrados en IA pueden reducir la cuota de mercado

Riesgos regulatorios de TOK

- Entorno regulatorio incierto: la normativa sobre IA y cripto puede afectar las operaciones de TOK

- Desafíos de cumplimiento: posibles problemas de privacidad y gobernanza de IA

- Restricciones internacionales: la regulación global puede limitar la adopción

Riesgos técnicos de TOK

- Dependencia de la red Solana: problemas en Solana pueden afectar el desempeño de TOK

- Vulnerabilidades en smart contracts: riesgo de exploits o fallos en el contrato

- Riesgos tecnológicos de la IA: los avances rápidos pueden exigir actualizaciones frecuentes

VI. Conclusión y recomendaciones

Valoración de TOK como inversión

TOK constituye una oportunidad singular en el sector de vídeo corto con IA sobre Solana. Si bien ofrece potencial de crecimiento a largo plazo en IA y blockchain, los riesgos a corto plazo son elevados debido a la volatilidad y la incertidumbre regulatoria.

Recomendaciones de inversión en TOK

✅ Principiantes: opta por posiciones pequeñas y experimentales tras investigar a fondo ✅ Inversores experimentados: aplica compras periódicas y gestión de riesgos estricta ✅ Institucionales: realiza una due diligence exhaustiva y contempla TOK como parte de una cartera diversificada

Formas de operar con TOK

- Trading spot: disponible en Gate.com para compra directa

- Staking: explora posibles opciones si el proyecto lo permite

- Integración DeFi: permanece atento a nuevas oportunidades DeFi en el ecosistema Solana

Invertir en criptomonedas conlleva un riesgo extremo; este artículo no constituye asesoramiento de inversión. Los inversores deben decidir en función de su tolerancia al riesgo y consultar a profesionales financieros. Nunca inviertas más de lo que puedas permitirte perder.

FAQ

¿Puede Tron llegar a 10 $?

Si bien es un objetivo ambicioso, 10 $ es posible con una adopción sólida, avances tecnológicos y un contexto de mercado favorable. El foco de TRON en DApps, DeFi y NFTs puede impulsar la demanda y el precio.

¿Floki coin alcanzará 1 $ en 2025?

No, no se prevé que Floki coin llegue a 1 $ en 2025. Las previsiones apuntan a un máximo de 0,000290 $ a cierre de año.

¿Puede Coti llegar a 10 $?

Sí, COTI podría alcanzar los 10 $ si se cumplen avances en privacidad e integración con soluciones Layer 2 de Ethereum. Las tendencias actuales indican que este objetivo es viable en un mercado alcista.

¿Solana alcanzará los 1 000 $ en 2025?

Según las tendencias y el potencial de Solana, podría llegar a 1 000 $ en 2025, aunque no está garantizado. Las condiciones de mercado y los avances tecnológicos serán determinantes para su precio futuro.

Predicción del precio de TOK en 2025: análisis de las tendencias del mercado y factores potenciales de crecimiento

¿Qué es ZEREBRO: guía completa sobre la revolucionaria plataforma de IA que transforma la innovación digital?

QFS Cripto Explicado: Lo que el Sistema Financiero Cuántico Significa para los Activos Digitales

Predicción del precio de TAO para 2025: análisis de tendencias del mercado y oportunidades de crecimiento en el ecosistema de criptomonedas en constante evolución

¿Qué es Moni? Una guía

Predicción del precio de FET en 2025: tendencias alcistas y factores clave que impulsan el valor futuro de Fetch.ai

Explorando la biblioteca Web3.js: guía para el desarrollo de blockchain

Guía completa para integrar soluciones Web3