Previsão do preço do POPCAT em 2025: exploração das tendências de mercado e do potencial de investimento na economia digital felina

Introdução: Posição de Mercado e Valor de Investimento da POPCAT

POPCAT (POPCAT), criptomoeda de meme inspirada numa imagem viral de um gato, tem vindo a atrair significativa atenção desde o lançamento. Em 2025, a POPCAT regista uma capitalização de mercado de 220 299 205 $, uma oferta circulante de cerca de 979 978 670 tokens e um preço próximo de 0,2248 $. Este ativo, conhecido como “O Meme Cat da Solana”, assume papel crescente no ecossistema das meme coins e dos social tokens.

Este artigo apresenta uma análise profissional do histórico e das tendências de preço da POPCAT entre 2025 e 2030, cruzando padrões históricos, dinâmica de oferta e procura, evolução do ecossistema e fatores macroeconómicos, para fornecer previsões e estratégias de investimento especializadas.

I. Revisão Histórica do Preço da POPCAT e Estado Atual do Mercado

Evolução Histórica do Preço da POPCAT

- 2023: Lançamento da POPCAT, preço inicial de 0,00024 $

- 2024: Novo máximo histórico de 2,0847 $ em 17 de novembro

- 2025: Queda acentuada, preço atingiu 0,0887 $ a 13 de abril

Situação Atual do Mercado da POPCAT

Em 24 de setembro de 2025, a POPCAT negocia a 0,2248 $, com uma capitalização de mercado de 220 299 205 $. O token valorizou 1,26 % na última hora, mas desvalorizou 1,18 % nas últimas 24 horas. Na última semana, o ativo perdeu 17,14 %, sendo que nos últimos 30 dias registou uma queda de 18,96 %. No acumulado anual, observa-se uma desvalorização de 75,71 %.

O preço atual situa-se 89,21 % abaixo do máximo histórico e 153,44 % acima do mínimo histórico. A oferta circulante totaliza 979 978 669,96 tokens, representando 99,99 % da oferta total (979 978 694 tokens). A capitalização de mercado diluída é de 220 299 210,41 $.

Atualmente, a POPCAT ocupa a 280.ª posição no ranking de criptomoedas, com uma dominância de mercado de 0,0053 %. O volume de negociação nas últimas 24 horas é de 1 569 050,72 $, evidenciando uma atividade moderada.

Clique para consultar o preço de mercado atual da POPCAT aqui

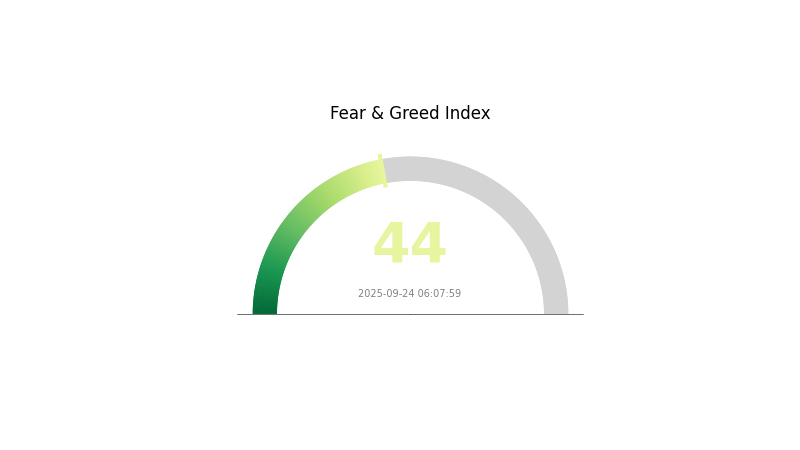

Indicador de Sentimento de Mercado POPCAT

2025-09-24 Índice de Medo e Ganância (Fear and Greed Index): 44 (Medo)

Clique para consultar o Índice de Medo e Ganância atualizado

O sentimento no mercado de criptomoedas mantém-se cauteloso, com o Índice de Medo e Ganância nos 44 pontos, em território de medo. Este valor indica hesitação e incerteza por parte dos investidores perante o ambiente de mercado. Nestes períodos, os investidores devem operar de forma informada e racional. O medo do mercado pode, por vezes, criar oportunidades de compra para investidores de longo prazo, mas é imprescindível realizar uma análise rigorosa e considerar o seu perfil de risco antes de investir.

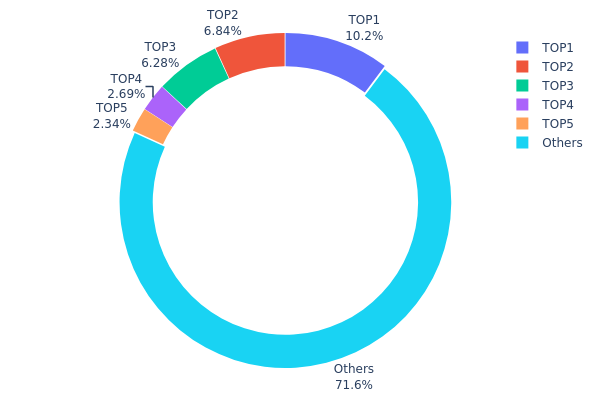

Distribuição de Detenção POPCAT

O gráfico de distribuição por endereços revela a concentração dos tokens POPCAT entre diferentes carteiras. Os dados evidenciam concentração moderada, com os 5 principais endereços a deterem 28,33 % da oferta total. O maior detentor possui 10,20 %, seguido por quatro endereços com quantidades entre 2,34 % e 6,83 %.

Esta estrutura sugere distribuição relativamente equilibrada: 71,67 % dos tokens estão dispersos entre pequenos detentores. Apesar de alguma concentração nos principais endereços, ela não é excessiva. Esta distribuição pode favorecer estabilidade, já que nenhuma entidade controla a maioria dos tokens. Contudo, ações coordenadas dos maiores titulares podem impactar o preço.

No global, a distribuição da POPCAT reflete descentralização moderada. A diversidade de detentores, grandes e pequenos, reforça uma estrutura saudável on-chain que pode apoiar a estabilidade do ecossistema e mitigar riscos de manipulação.

Clique para analisar a Distribuição de Detenção POPCAT atual

| Top | Endereço | Qtd. Detida | % Detida |

|---|---|---|---|

| 1 | CSSJFg...V195Jb | 100 000,01K | 10,20 % |

| 2 | 4xLpwx...k99Qdg | 67 012,94K | 6,83 % |

| 3 | 9Zifro...bPoL2x | 61 533,02K | 6,27 % |

| 4 | u6PJ8D...ynXq2w | 26 363,49K | 2,69 % |

| 5 | 5Q544f...pge4j1 | 22 956,14K | 2,34 % |

| - | Outros | 702 073,53K | 71,67 % |

II. Principais Fatores que Influenciam o Valor Futuro da POPCAT

Mecanismo de Oferta

- Oferta de iniciativa comunitária: O fornecimento é fortemente condicionado pelo envolvimento da comunidade.

- Padrões históricos: Alterações anteriores na oferta correlacionam-se de forma relevante com flutuações de preço.

- Impacto atual: O aumento da participação comunitária poderá impulsionar a procura e influenciar a dinâmica de oferta.

Dinâmica Institucional e de Grandes Detentores

- Participação institucional: Algumas instituições estão a demonstrar maior interesse pela POPCAT, podendo influenciar a trajetória do ativo.

Contexto Macroeconómico

- Potencial de proteção contra inflação: A POPCAT revelou capacidade de atuação como hedge face à inflação no panorama económico atual.

Desenvolvimento Tecnológico e Ecossistema

- Integração com plataformas sociais: Maior integração com redes sociais deverá impulsionar visibilidade e adoção.

- Projetos de ecossistema: Progresso acelerado em DApps e iniciativas centradas na POPCAT.

III. Previsão de Preço POPCAT 2025-2030

Perspetiva para 2025

- Cenário conservador: 0,14612 $ – 0,20 $

- Cenário neutro: 0,20 $ – 0,225 $

- Cenário otimista: 0,225 $ – 0,25627 $ (dependente de sentimento positivo de mercado)

Perspetiva para 2027

- Expectativa de ciclo: Fase de crescimento possível

- Intervalos de preço:

- 2026: 0,1804 $ – 0,28624 $

- 2027: 0,16857 $ – 0,29763 $

- Principais catalisadores: Adoção crescente e avanços técnicos

Perspetiva de Longo Prazo 2030

- Cenário base: 0,28 $ – 0,32 $ (crescimento regular do mercado)

- Cenário otimista: 0,32 $ – 0,36 $ (desempenho global positivo)

- Cenário transformativo: 0,36 $ – 0,39723 $ (inovação disruptiva e adoção em massa)

- 2030-12-31: POPCAT 0,31034 $ (previsão média)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,25627 | 0,2248 | 0,14612 | 0 |

| 2026 | 0,28624 | 0,24054 | 0,1804 | 7 |

| 2027 | 0,29763 | 0,26339 | 0,16857 | 17 |

| 2028 | 0,28892 | 0,28051 | 0,15989 | 24 |

| 2029 | 0,33596 | 0,28471 | 0,17937 | 26 |

| 2030 | 0,39723 | 0,31034 | 0,26689 | 38 |

IV. Estratégias Profissionais de Investimento e Gestão de Risco em POPCAT

Metodologia de Investimento POPCAT

(1) Estratégia de Detenção de Longo Prazo

- Indicado para: Investidores tolerantes ao risco e com visão de longo prazo

- Sugestões operacionais:

- Acumular tokens POPCAT em ciclos de correção

- Definir metas de preço para realização parcial de lucros

- Armazenar tokens em carteira hardware segura

(2) Estratégia de Trading Ativo

- Ferramentas técnicas:

- Médias móveis para identificar tendências e pontos de inversão

- RSI para monitorização de sobrecompra/sobrevenda

- Pontos principais para swing trading:

- Análise do sentimento social para identificar catalisadores de preço

- Definir ordens de stop-loss para limitar perdas

Estrutura de Gestão de Risco POPCAT

(1) Princípios de Alocação de Ativos

- Investidor conservador: 1–3 % do portefólio de criptoativos

- Investidor agressivo: 5–10 % do portefólio

- Investidor profissional: Até 15 % do portefólio

(2) Estratégias de Hedge de Risco

- Diversificação: Investir de forma repartida em várias criptomoedas

- Stop-loss: Usar para limitar potenciais perdas

(3) Soluções de Armazenamento Seguro

- Hot wallet recomendada: Gate web3 wallet

- Armazenamento frio: Carteira hardware para ativos de longo prazo

- Segurança: Autenticação de dois fatores e proteção das chaves privadas

V. Riscos e Desafios da POPCAT

Riscos de Mercado POPCAT

- Volatilidade elevada: Oscilações acentuadas são comuns em criptoativos de meme

- Risco de liquidez: Dificuldades na venda de grandes posições

- Mudanças abruptas no sentimento de mercado: Popularidade variável afeta o preço

Riscos Regulatórios POPCAT

- Scrutínio acrescido: Possíveis ações regulatórias contra tokens de meme

- Incerteza legal: Regulação indefinida em jurisdições distintas

- Exclusão em plataformas: Risco de deslistagem por questões de conformidade

Riscos Técnicos POPCAT

- Vulnerabilidades em smart contracts: Potenciais riscos de exploração

- Congestão de rede: Atrasos em períodos de alta procura

- Compatibilidade de carteiras: Suporte limitado em algumas soluções

VI. Conclusão e Recomendações Práticas

Avaliação do Valor de Investimento POPCAT

A POPCAT representa uma oportunidade de risco elevado e potencial retorno significativo no segmento das meme coins. Embora tenha valorizado de forma relevante, o valor sustentado permanece especulativo, e os riscos de curto prazo incluem volatilidade extrema e desafios regulatórios.

Recomendações para Investimento em POPCAT

✅ Iniciantes: Limite a exposição a uma percentagem reduzida do portefólio

✅ Investidores experientes: Explore oportunidades de trading com gestão rigorosa de risco

✅ Institucionais: Considere exposição cautelosa, integrando POPCAT numa carteira diversificada de meme tokens

Formas de Participação no Mercado POPCAT

- Negociação à vista: Comprar e vender POPCAT na Gate.com

- Ordens limitadas: Definir preços de entrada e saída para gerir risco

- Compra periódica: Acumular gradualmente para mitigar volatilidade

Os ativos digitais implicam riscos muito elevados. Este artigo não constitui conselho financeiro. Considere o seu perfil de risco e recorra a orientação especializada antes de investir. Nunca invista mais do que está disposto a perder.

FAQ

A POPCAT é um bom investimento?

A POPCAT evidencia potencial como meme coin viral na Solana, embora com risco elevado e possível retorno relevante no atual mercado altista.

A POPCAT pode recuperar?

A POPCAT pode desvalorizar para o intervalo de 0,15 $ – 0,23 $. Futuras apreciações são incertas e as tendências atuais sugerem descida.

POPCAT pode atingir os 2 $?

Segundo as tendências de mercado e enfraquecimento dos fundamentos, é pouco provável que a POPCAT atinja 2 $ num futuro próximo.

Qual o valor potencial futuro da POPCAT?

Em cenário de tendência altista sustentada, a POPCAT poderá atingir 1,57 $ em 2026 e 3,42 $ em 2030.

Previsão do Preço da BOME para 2025: Orientar-se pelas Tendências de Mercado e pelas Oportunidades de Investimento numa Economia Volátil

Previsão de Preço PNUT para 2025: Explorar o Potencial de Crescimento e a Dinâmica de Mercado no Ecossistema em Transformação dos Ativos Digitais

Previsão do preço MYRO para 2025: análise do potencial de crescimento e das tendências de mercado no contexto dinâmico das criptomoedas

Será o XAI gork (GORK) um investimento vantajoso?: Análise do Potencial e dos Riscos dos Tokens GORK no Mercado de Inteligência Artificial Explicável

Será o dogwifhat (WIF) um bom investimento?: Avaliação do potencial e dos riscos da mais recente tendência das meme coins

Previsão do Preço PUNDU em 2025: Análise das Tendências de Mercado e Fatores Potenciais de Crescimento

Compreender o conceito de bridges em blockchain

O que é BTR: Guia Completo sobre Beyond the Rack e o seu impacto no comércio eletrónico

O que é CGN: Guia Completo sobre Conditional Generation Networks e respetivas aplicações na inteligência artificial moderna

O que é PUMPBTC: Guia Completo sobre o Bitcoin Pump Token e o Seu Impacto no Mercado